So you applied for that new credit card with the huge upfront spending bonus.

So you applied for that new credit card with the huge upfront spending bonus.Now you’re left wondering “how the heck am I going to spend $xxxx.xx in x months.”

You might not have even made it that far.

You may look at those upfront spending requirements (e.g. spend $5,000 in 3 months and receive 50,000 bonus points) and never apply, thinking you’d never spend that amount of money…

What to Look for When Comparing Medicare Part D Costs

– moneyning.com/

One of the timeless ways to save money is to comparison shop, and switching to a Medicare Part D plan that costs the least amount of money would be a great way to save. But yet, only about seven percent of seniors who enroll in Medicare Part D changes plans each year, according to the Centers for Medicare and Medicaid Services…

Better Ways to Invest Your Tax Refund Money

– onecentatatime.com

Did you get your tax refund money back yet? Did you know that the average person receives a refund of nearly $3,000? If you are receiving a check for three grand, what on earth do you plan on doing with that kind of money?

Did you get your tax refund money back yet? Did you know that the average person receives a refund of nearly $3,000? If you are receiving a check for three grand, what on earth do you plan on doing with that kind of money?Investing Tax refund

I know some people would spend it foolishly by taking a lavish vacation in the Caribbean or for a season golf membership…

Peer to Peer Lending Worked for Me!

– financialhighway.com/

This post was originally published on August 13, 2011. This is an updated version.

This post was originally published on August 13, 2011. This is an updated version.I don’t typically write first person stories about my own financial situation. However, I had a really positive experience with social lending. Although a lot of people have used peer-to-peer lending for both borrowing loans and investing money, there are still many people out there who don’t know if social lending is right for them…

All you need to know about saving for retirement

– getrichslowly.org/blog

Money Quickies And Mall Smells For May 15,2013

– solvingthemoneypuzzle.com/

Last night I was exchanging frustrating emails with my future potential rental property business partner while watching several episodes of World’s Worst Tenants. I would advise anyone who was considering becoming a landlord to avoid watching this show as the tenants are scary freaks who think they may be werewolves or who may engage in religious sacrifice in your rental unit…

Last night I was exchanging frustrating emails with my future potential rental property business partner while watching several episodes of World’s Worst Tenants. I would advise anyone who was considering becoming a landlord to avoid watching this show as the tenants are scary freaks who think they may be werewolves or who may engage in religious sacrifice in your rental unit…Average Tax Refunds

– freemoneyfinance.com

Income: $25k-50k; Average Refund: $2,774

Income: $50k-75k; Average Refund: $3,051

Income: $75k-100k; Average Refund: $3,657

Income: $100k-200k; Average Refund: $4,704

I’m wondering if these are too high or not. On one hand, it seems like a lot of money that’s “loaned” to the federal government each year…

$45 Million Stolen in Hours With Prepaid Cards

– moneytalksnews.com

Celebrities from Justin Bieber to Kim Kardashian and even popular cartoon characters have been used to promote prepaid debit cards.But here are some mascots you’re unlikely to see gracing prepaid plastic: the eight guys indicted last week as part of an international cybercrime ring that authorities say stole $45 million from thousands of ATMs around the world…

Celebrities from Justin Bieber to Kim Kardashian and even popular cartoon characters have been used to promote prepaid debit cards.But here are some mascots you’re unlikely to see gracing prepaid plastic: the eight guys indicted last week as part of an international cybercrime ring that authorities say stole $45 million from thousands of ATMs around the world…Feeling “Cheap” or “Poor”

– thesimepledollar.com

They’ll serve a homemade meal that someone turns their nose up at because it’s not a prime cut. They’ll bring a thoughtful gift to a party only to find that everyone else paid out the nose for their shiny gifts…

A 15 Cent Banana and Thoughts on Regular People

– youngcheapliving.com

The Top 10 Cheapest Cities for New College Grads (& Everyone Else)

– 20somethingfinance.com/

Catering articles to the young professional audience is a big part of what 20somethingfinance is all about, of course. And what better way to do that than to highlight some of the cheapest cities that new grads can move to?

Catering articles to the young professional audience is a big part of what 20somethingfinance is all about, of course. And what better way to do that than to highlight some of the cheapest cities that new grads can move to?Now, if you want cheap, you could move to the backwoods of northern Michigan, but:

a…

Join our Tweetchat this Thursday at 12:00 pm Pacific for lively conversation and a chance to win prizes! Use #WBChat to participate.

This week’s topic: Having a frugal Memorial Day Weekend! Learn about taking advantage of sales, saving on travel, and throwing a frugal BBQ! Tell us about your Memorial Day Weekend plans and let us know your number one tip for keeping things frugal this Memorial Day!

For an easy way to keep track of the conversation, try using our special Tweetchat Chatroom…

How to Make Productive Use of your Free Time – Part Two

– youngadultmoney.com/

This is part two of a two-part series on making productive use of your free time. If you missed part one, check it out here.

This is part two of a two-part series on making productive use of your free time. If you missed part one, check it out here.Welcome to part two of our two-part series on making productive use of your time. Today I will share some more ideas of how to make productive use of your “extra” time each day…

Competing With Yourself To Save On Utility Bills

– prairieEcothrifter.com

Unlike most people, I actually look forward to receiving my utility bills each month. Hard to believe? Let me explain.

Unlike most people, I actually look forward to receiving my utility bills each month. Hard to believe? Let me explain.I view each month’s bill – whether it be from the water company, the electric utility, or the natural gas provider – as a way to gauge how well I am doing in my efforts to both conserve energy and save money…

Do you DIY or Pay for Help?

– canadianfinanceblog.com

When you’re thinking about doing home repair, renovation, or improvements, budget is usually at the top of the list. We all have dreams of what our house could look like – someday, if only we had the money. Money, however, is often the biggest detriment to our hopes and dreams.

When you’re thinking about doing home repair, renovation, or improvements, budget is usually at the top of the list. We all have dreams of what our house could look like – someday, if only we had the money. Money, however, is often the biggest detriment to our hopes and dreams.It would be nice to add a third story to our house, or dig out the basement…

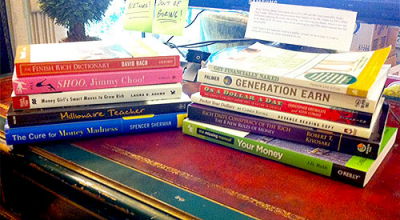

Box of Books Giveaway: Round II

– budgetsaresexy.com/

Okay, here we go – round two of giving away my finance books! Hopefully you or someone you know can use them 🙂 If not, pick the ones out you want and then donate/sell the rest!

And if you missed yesterday’s awesome shelf clearing, be sure to go back and check it out once you’re done entering this giveaway here today…

Here’s what’s in Box #2:

Your Money: The Missing Manual by J…

New Horizons for Seniors Program

– milliondollarjourney.com

As more people retire, there is a good chance that many of them would want to remain active and still contribute to society in some new form by utilizing their well-developed skill sets…

Thursday Poll: Housing

– punchdebtintheface.com