Recent Buy – ONEOK Inc (OKE)

– myfijourney.com

As part of my commitment to keep my readers up to date on my portfolio, I write up short posts describing my transactions. Recently, I purchased 26 shares of ONEOK Inc (OKE).

These 26 shares have a total cost basis of $1,115.40, which works out to about $42.90 per share. I feel that this is a fair value, especially given currently overvalued nature of the market…

Things you need to Know Before you Become a Landlord

– frugalrules.com

After you read today’s post, please head on over to the Tour de Personal Finance at My Personal Finance Journey and vote for “Time”. I am in the FINAL, so every vote is appreciated! Now on to the post…

The following is a guest post from my good friend Pauline, at Make Money Your Way. If you’re interested in submitting a guest post, please consult my guest posting guidelines and contact me…

The following is a guest post from my good friend Pauline, at Make Money Your Way. If you’re interested in submitting a guest post, please consult my guest posting guidelines and contact me…

What Bad Financial Habits Do You Have? Part 1

– makingsenseofcents.com

Photo Credit

Photo CreditEveryone most likely has some sort of bad financial habit that they take part in. Now that my student loans are gone, I have been evaluating the many other financial areas in our lives.

No one is perfect, and I definitely am not. I know that I share my weekly and monthly extra income all the time, but a bigger income does not mean that all financial worries are gone! This larger income has only been happening for less than one year, and before that we were very used to a relatively small amount of monthly income and living on a small budget…

Give to Get

– dinksfinance.com

Hi All,

Hi All,For a couples blog, I tend not to say a whole lot about marriage and money, but I did want to take a minute to extoll the virtue of compromise in keeping your marital finances healthy.

My wife and I have very different priorities when it comes to money. Me – I’d rather be socking all my available cash into stocks, businesses or other appreciating assets…

5 Rules For Using Credit Cards And Not Getting Into Debt

– debtroundup.com

In principle, a credit card is really simple to use. You simply make purchases and pay your credit card bill each month, and that’s all there is to it. However, it’s amazing just how many people end up in debt because they fail understand the basic rules for using a credit card. If you want to avoid a similar situation, here are the 5 most important rules for using a credit card responsibly:

In principle, a credit card is really simple to use. You simply make purchases and pay your credit card bill each month, and that’s all there is to it. However, it’s amazing just how many people end up in debt because they fail understand the basic rules for using a credit card. If you want to avoid a similar situation, here are the 5 most important rules for using a credit card responsibly:Rule #1 – Pay your bill on time

This sounds obvious, but many people forget to pay their bill or think it’ll be ok to pay it late…

Can There Ever Be A French Revolution In The United States?

– doablefinance.com

This post is dedicated to the folks who can afford a value meal at a fast-food joint, especially the dollar menu. It’s always heart-breaking [or is it heart-warming?] to know that no matter how good or poorly the economy may be doing, we will always have the robber-baron class. They will always have something to …

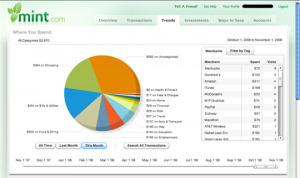

Mint Freshens Your Finances Instead of Your Breath

– johnnymoneyseed.com

The “B word” may be one of the dirtiest words in the English language. It feels crude rolling off the tongue and is best not said to friends or family. The “B word” can incite rage when spoken aloud in front of the wrong person. Or perhaps it isn’t the nasty word everyone makes it out to be…

The “B word” may be one of the dirtiest words in the English language. It feels crude rolling off the tongue and is best not said to friends or family. The “B word” can incite rage when spoken aloud in front of the wrong person. Or perhaps it isn’t the nasty word everyone makes it out to be…3 Things I Learned from Warren Buffet

– clubthrifty.com

3 Things I Learned from Warren Buffet

3 Things I Learned from Warren BuffetClub Thrifty – Stop spending. Start living.

Please enjoy this guest post from Nick who blogs over at BayCrazy.com.

Warren Buffett is often ranked the richest man in the world. With that being said, I think it’s fair to say that he knows what he’s doing…

3 Ways to Graduate College Debt Free

– moneylifeandmore.com

Today we welcome back our Tuesday contributor, Catherine Alford!

Today we welcome back our Tuesday contributor, Catherine Alford!It’s no secret that college tuition is climbing every year, and I don’t even want to think about how much it’s going to cost when my not-here-yet kids get to go.

One thing I really want for them is to graduate without debt. Student loan debt has been so pervasive in my life, and I want them to be much smarter about handling it than I was…

8 Banking Options for College Students

– doughroller.net

If you held a part-time job in high school, you may have a bank account or even a credit card in your name. But if you didn’t work — maybe you just cashed those babysitting checks — you may not be used to dealing with more than just some money in your pocket.

If you held a part-time job in high school, you may have a bank account or even a credit card in your name. But if you didn’t work — maybe you just cashed those babysitting checks — you may not be used to dealing with more than just some money in your pocket.In college it’s a different ballgame: 23 percent of full-time under-graduate students work 20 or more hours a week, and most college students work at least a few hours a week…

I Purchased a New Truck

– Financialblacksheep.com

The only picture I have of my new truck thus far-my diagram of where I need to take bolts off in order to get to all of the spark plug wires lol. Well, it’s not a new truck, but a … Continue reading →The post I Purchased a New Truck appeared first on Financial Black Sheep.