Cyprus Reminds The World To Diversify Our Assets And Never Trust The Government

– financialsamurai.com

10 Uses for All Those Chopsticks

– moneytalksnews.com

Why Catastrophic is Better than No Health Insurance at All

– moneysmartlife.com

A lot of people are turned off by the very mention of catastrophic health insurance. It may be that some see it as inadequate coverage, while others see it as a mystery concept filled with unimagined traps. But is that the real truth? In most cases having catastrophic is better than having no health insurance at all…

A lot of people are turned off by the very mention of catastrophic health insurance. It may be that some see it as inadequate coverage, while others see it as a mystery concept filled with unimagined traps. But is that the real truth? In most cases having catastrophic is better than having no health insurance at all…Take Charge of Your Credit Cards

– moneyinfant.com

Investing in your investing education: A resource list

– getrichslowly.org/blog

Does Your Job’s Pay and Compensation align with Performance and Output?

– youngadultmoney.com/

Over the past couple weeks I’ve had a number of conversations with co-workers and others about whether pay and compensation aligns with our job performance.

My friend tried to make the argument that in corporate America you get paid not based on how many hours you work but on what you produce…

Should Credit Cards Reward Good Behavior?

– wisebread.com

There’s a new credit card in town, and it wants to give you a helping hand. Bank of America launched the BankAmericard Better Balance Rewards card earlier this month.

Here’s how it works: You can earn $25 in cash rewards each quarter if you make your payment on time and pay more than the required minimum payment…

Traveling With Kids: Do You Really Need The Gadgets?

– prairieEcothrifter.com

One of the highlights of my year is the annual road trip I take with my son for spring break. We take five or six days, and we head down to my grandpa’s in Arizona, taking detours along the way. One thing I’m adamant about, however, is that my son not spend the whole trip buried in a Nintendo DS, or using some other electronic gadget…

One of the highlights of my year is the annual road trip I take with my son for spring break. We take five or six days, and we head down to my grandpa’s in Arizona, taking detours along the way. One thing I’m adamant about, however, is that my son not spend the whole trip buried in a Nintendo DS, or using some other electronic gadget…Should Payday Loans be Banned?

– 20somethingfinance.com/

Nothing good can come from a payday loan.

Nothing good can come from a payday loan.According to new research from Pew, the average payday loan borrower must pay back $400 within two weeks, but can only afford a $50 payment. What comes next? A never-ending cycle of debt and $500 in average additional fees over five months.

Only 14% of borrowers can afford to repay the loans with their monthly budget…

Low Cost ETFs – Canadian Vanguard ETFs

– milliondollarjourney.com

Five Red Flags that Could Trigger an Audit

– free money wisdom

What can trigger an audit of your income tax returns? There are actually any number of factors, and the IRS isn’t always forthcoming in telling us what they are. But there are at least five that could result in an audit, and you may want to keep these in mind as you prepare your income taxes for this year

What can trigger an audit of your income tax returns? There are actually any number of factors, and the IRS isn’t always forthcoming in telling us what they are. But there are at least five that could result in an audit, and you may want to keep these in mind as you prepare your income taxes for this yearHigh income

This is one you have no control over, although it certainly comes under the category of a “good problem”…

Big Government vs. Small Government – Which Is Ideal for the U.S.?

– moneycrashers.com

A Step-By-Step Guide to Using Mint.com to Get Out of Debt

– debtmovement.com/blog/

Being in debt is a special kind of miserable.

Being in debt is a special kind of miserable.You work extremely hard to bring home a paycheck, only to watch a chunk of it fly out the door each month. Ugh.

Student loan debts can be particularly irritating if they are for a degree in a field where you no longer want to work.

That was the case with my grad school debt, which I eventually saw as “cadaver debt,” or dead weight that didn’t add value or have the prospect of adding value…

Are Sophisticated Producers Taking Advantage of Their Fans With Kickstarter?

– consumerismcommentary.com/

I like the concept of crowdfunding. Websites like Kickstarter have been helpful to start-up businesses, sole individuals with an idea but without capital, and independent entertainers looking for support for their first project. It’s democratic capitalism; the best ideas receive necessary funding while the “investors” receive neither a financial return nor equity…

I like the concept of crowdfunding. Websites like Kickstarter have been helpful to start-up businesses, sole individuals with an idea but without capital, and independent entertainers looking for support for their first project. It’s democratic capitalism; the best ideas receive necessary funding while the “investors” receive neither a financial return nor equity…The Many College-Related Decisions

– freemoneyfinance.com

In the past, it was pretty clear that going to college gave the average worker a huge advantage in the workplace…

I Love A Good Book + A Giveaway!

– budgetblonde.com

I had the most glorious weekend this past weekend. It wasn’t filled with waterfalls or the beach. All it involved was a new book and a ridiculously awesome nap.

I had the most glorious weekend this past weekend. It wasn’t filled with waterfalls or the beach. All it involved was a new book and a ridiculously awesome nap.Ever since I was a little kid, I’ve just loved curling up with a good book. I don’t know what it is, but when I read and get lost in a book, I feel truly happy…

Avoiding the Pain of Romance Scammers

– moneyning.com/

Online dating has become the norm these days.

But, once upon a time, people relied on their in-person networks to find love and romance. They had to wait on their cousin to introduce them to a coworker. Or they went to clubs and bars, where they met not-so nice guys and got frustrated.

Then, along came online dating sites, which set people up via profile matches and interest lists…

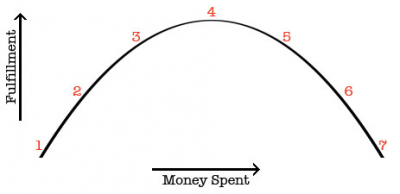

Another Look at the Fulfillment Curve

– thesimepledollar.com

Almost five years ago, I posted an article on the idea of the “fulfillment curve.”

Almost five years ago, I posted an article on the idea of the “fulfillment curve.”For those unfamiliar with it, the “fulfillment curve” is an idea presented in the book Your Money or Your Life which says that there’s a sweet spot for anything that maximizes the fulfillment you get out of it…

Making Money Make Sense with Jean Chatzky’s Money School

– ptmoney.com

It may only be spring, but it’s the perfect time to go back to school.

It may only be spring, but it’s the perfect time to go back to school.You all know the importance of learning positive money skills. However, it can be difficult to know where to start with the overwhelming amount of money information available.

That’s why NBC’s TODAY Show financial editor Jean Chatzky has decided to provide beginners with an excellent entry into the world of finance—Jean Chatzky’s Money School offers direct instruction and conversation with a recognized expert through five affordable online classes this spring…

How to Effectively use Vouchers and Coupons

– onecentatatime.com

I use coupons and vouchers, but not insanely. Even though I believe that using coupons won’t make us rich, I use Priceline for our hotel and airfare often. I do try to look for coupons for every big ticket purchase. Once we were obsessive, especially right after coming to this country, actually online coupons increased our spending…

I use coupons and vouchers, but not insanely. Even though I believe that using coupons won’t make us rich, I use Priceline for our hotel and airfare often. I do try to look for coupons for every big ticket purchase. Once we were obsessive, especially right after coming to this country, actually online coupons increased our spending…Thinking lowering your business fees for a client is worth it? Think again.

– moneylicious.org/

You can agree “women in business” is no longer an oxymoron. Thanks to the advancement of technology coupled with economic and societal changes more women are becoming creators of their own companies. I’ve had the privilege to communicate with extraordinary women in the financial industry to technology to small business owners…

You can agree “women in business” is no longer an oxymoron. Thanks to the advancement of technology coupled with economic and societal changes more women are becoming creators of their own companies. I’ve had the privilege to communicate with extraordinary women in the financial industry to technology to small business owners…Do I Consider My Pension In My Asset Allocation?

– canadianfinanceblog.com

I’m a big fan of the theory that basic asset allocation is likely to have a larger impact on the real returns of most investors’ portfolios than how good they are at picking specific stocks. Numerous academic studies back up that assessment, and given the average person’s inability to rationally think about stock or bond market returns, this makes a lot of common sense as well…

I’m a big fan of the theory that basic asset allocation is likely to have a larger impact on the real returns of most investors’ portfolios than how good they are at picking specific stocks. Numerous academic studies back up that assessment, and given the average person’s inability to rationally think about stock or bond market returns, this makes a lot of common sense as well…How to Sabotage Your Credit Score

– financialhighway.com/

You don’t need a good credit score, right? After all, do you really need lower interest rates? Plus, lower insurance rates are kind of over-rated anyway.

You don’t need a good credit score, right? After all, do you really need lower interest rates? Plus, lower insurance rates are kind of over-rated anyway.If you are ready to really take your credit score down a notch or two, here are some solid ways to take your rating to new lows:

1. Pay Late

One of the best ways to bring your score down in a hurry is to pay late…

One thought on “Why Catastrophic is Better than No Health Insurance at All + MORE”

Comments are closed.