Passive Income Targets – June 2013

– intelligentspeculator.net

It was a fairly slow month but I do feel like things are getting much clearer. Why? I’m convinced that I want to carefully start investing on margin and build my own mini-Berkshire empire. It’s been tricky to save as much in the past few weeks so I’ll be putting more focus on reducing my spending to set more aside…

It was a fairly slow month but I do feel like things are getting much clearer. Why? I’m convinced that I want to carefully start investing on margin and build my own mini-Berkshire empire. It’s been tricky to save as much in the past few weeks so I’ll be putting more focus on reducing my spending to set more aside…Vertex Pharmaceuticals Moves Up In Market Cap Rank, Passing Intuit

– forbes.com/sites/dividendchannel

In the latest look at stocks ordered by largest market capitalization, Russell 3000 component Vertex Pharmaceuticals, Inc. (NASD: VRTX) was identified as having a larger market cap than the smaller end of the S&P 500, for example Intuit Inc (NASD: INTU), according to The Online Investor. Click here to find out the top S&P 500 components ordered by average analyst rating »

Canadian Utilities Ltd. (CU) 2-for-1 split happen today!

– myfirst50000.com

There’s no hot water in my building for now. I guess I was lucky because this morning, I had hot water and was able to get a hot, a very hot shower. And yes, I was alone in that shower.Yesterday, it rain all day long and I cleaned my one and half apartment, I watched TV online, went outside in the rain for my grocery shopping and I did my lunch for the week…

River Valley Bancorp (RIVR) Declares $0.21 Quarterly Dividend; 3.8% Yield

– streetinsider.com

Visit StreetInsider.com at http://www.streetinsider.com/Dividends/River+Valley+Bancorp+%28RIVR%29+Declares+%240.21+Quarterly+Dividend%3B+3.8%25+Yield/8428793.html for the full story.

Dividend income is more stable than capital gains

– dividendgrowthinvestor.com

Over the past century stocks have delivered a 10% annual total return on average. The total return consists of price appreciation and dividend payments. The issue with average returns is that over the past century, there are only a few occasions where stocks clocked in annual returns of somewhere close to 10% in a given year…

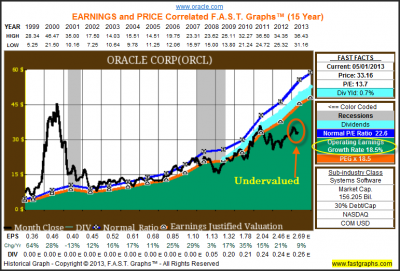

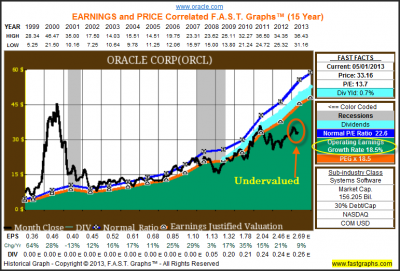

Oracle Corp: Fundamental Stock Research Analysis

– thediv-net.com

Before analyzing a company for investment, it’s important to have a perspective on how well the business has performed. Because at the end of the day, if you are an investor, you are buying the business. The FAST Graphs™ presented with this article will focus first on the business behind the stock…

Before analyzing a company for investment, it’s important to have a perspective on how well the business has performed. Because at the end of the day, if you are an investor, you are buying the business. The FAST Graphs™ presented with this article will focus first on the business behind the stock…Are U.S. Stocks Overvalued?

– dividends4life.com

The U.S. equity market is one of the best performing market among developed countries so far this year. For example, the S&P 500 is up by 14.35% on price return basis and 15.37% on total return basis year-to-date. Financials have skyrocketed with the sector in the index up by over 20%. Healthcare and Consumer Discretionary sectors also have had a great with a return of 20% or closer to that…