The Happiness Advantage

– savvyfinanciallatina.com/#&panel1-

Are you happy?

I’m really weird. Ever since I was 6 years old, I have been wanting to improve. I constantly place new challenges, and every time I accomplish these challenges, I set new ones. The cycle repeats itself.

Well, except for my time spent in the kitchen. Despite the fact I have been on my own for a while, I have managed to NOT learn many recipes…

I’m really weird. Ever since I was 6 years old, I have been wanting to improve. I constantly place new challenges, and every time I accomplish these challenges, I set new ones. The cycle repeats itself.

Well, except for my time spent in the kitchen. Despite the fact I have been on my own for a while, I have managed to NOT learn many recipes…

Basic Car Maintenance You Can Perform Yourself

– edwardantrobus.com

English: Spouses learn basic auto maintenance and emergency care at the 3rd Brigade Combat Team’s spouse retreat held at the Crown Reef Resort in Myrtle Beach, S.C. Saturday and Sunday. (Photo credit: Wikipedia)

English: Spouses learn basic auto maintenance and emergency care at the 3rd Brigade Combat Team’s spouse retreat held at the Crown Reef Resort in Myrtle Beach, S.C. Saturday and Sunday. (Photo credit: Wikipedia)If you are like most people, including myself. car maintenance is one of those chores that you know needs to be done, but you’d rather not do…

Why I Decided to Make a Career Change

– clubthrifty.com

Why I Decided to Make a Career Change

Why I Decided to Make a Career ChangeClub Thrifty – Stop spending. Start living.Well Thriftaholics, we’ve got some more life-changing news to announce to you. After 6 1/2 years at my current job and nearly a decade working in and around the funeral industry, I’ve decided to make a career change…

Blog Roundup #17 and a Guest Post on Career Avoidance

– ayoungpro.com

****I have a guest post up on Career Avoidance today entitled “Embrace Your Pain“. Go check it out!!!****One of the things I firmly believe in as a young professional is the need to always look for ways to improve yourself. Because of that, I have been a frequent reader of blogs and they have helped me out a lot! Here are some great posts I read this week:Link LoveJohn from Frugal Rules wants to know if employees care about their employers anymore…

Top 10 Reasons Friends With Debt Are No Fun!

– studentdebtsurvivor.com

When I was in debt, I wasn’t a lot of fun to be around. I’d like to think I’ve always been a good friend, but the debt definitely impacted my emotions and tainted my outlook on life. Let’s be honest, It’s hard to be happy when you’re suffocating under a $30k “debt blanket”…

When I was in debt, I wasn’t a lot of fun to be around. I’d like to think I’ve always been a good friend, but the debt definitely impacted my emotions and tainted my outlook on life. Let’s be honest, It’s hard to be happy when you’re suffocating under a $30k “debt blanket”…How Fragile Are Your Finances?

– www.enemyofdebt.com/

Image courtesy of Stuart Miles / FreeDigitalPhotos.net

Image courtesy of Stuart Miles / FreeDigitalPhotos.netFinancially Fragile. What do those words mean to you?

A few months ago TeamEOD writer Dr. Cabler wrote a post addressing the subject of being financially fragile. He gave the example that the majority of Americans would have to sell some of their possessions if they had to come up with $2000 within 30 days…

Tips and Tricks to Save Money on Travel

– doughroller.net

Travel is a big line item in my budget. My husband and I love to travel, and we try to leave the country at least once a year. In addition, we try to take one smaller trip within the U.S. To keep from breaking the bank with every trip, I’ve picked up a few tips and tricks along the way.

Pick the Right Destination

If you don’t have a particular destination in mind, but you want a good deal, sign up for Travel Zoo’s Top 20…

Pick the Right Destination

If you don’t have a particular destination in mind, but you want a good deal, sign up for Travel Zoo’s Top 20…

HAS (HAS) Dividend Stock Analysis

– myfijourney.com

Hasbro (HAS) is producer of children’s and family leisure time and entertainment products and services, better known as toys and games. Hasbro contains an estimated 10% of the market share of US toys in 2012 making it the second largest US toy manufactuer.Some of it’s brands include Transformers, GI Joe, Monopoly, Tonka, My Little Pony, Parker Brothers, and Magic:The Gathering…

Hasbro (HAS) is producer of children’s and family leisure time and entertainment products and services, better known as toys and games. Hasbro contains an estimated 10% of the market share of US toys in 2012 making it the second largest US toy manufactuer.Some of it’s brands include Transformers, GI Joe, Monopoly, Tonka, My Little Pony, Parker Brothers, and Magic:The Gathering…Life Updates and $3,287 in Extra Income

– makingsenseofcents.com

That’s part of my sister’s lovely face on the left and me on the right…

That’s part of my sister’s lovely face on the left and me on the right…Hey everyone! Happy Monday. The weekend went by too quickly, yet again. Hope all of you fathers enjoyed Father’s Day!

We took our engagement photos on Thursday night, and it went well! I was super nervous but our photographer was awesome…

GAME DAY: “Tapering?” So You Wanna Be Mayor Of MakinSense Babe?

– makingsensebabe.com

The word “tapering” is flying around the news today. What do you think that means?

The word “tapering” is flying around the news today. What do you think that means?Choose 1 – 5 below (only one).

Put your answer in the comments below, or on Facebook or Twitter @makinsensebabe and tell us what “tapering” means for your money. I will respond with yay/nay (you’re a winner, or a loser)…

Power Corrupts, and Absolute Power Corrupts Absolutely

– monsterpiggybank.com

Everywhere I look I see corruption, abuse of power and blatant lies from governments and government backed agencies. The most recent of these was the scandal that has been brought to light by Edward Snowden where the NSA has been collecting records of every electronic transfer of information going into and out of the USA…

Everywhere I look I see corruption, abuse of power and blatant lies from governments and government backed agencies. The most recent of these was the scandal that has been brought to light by Edward Snowden where the NSA has been collecting records of every electronic transfer of information going into and out of the USA…Do You DIY to Save?

– debtroundup.com

Lately, I have been helping out my good friend get his new house into shape. He bought a fixer upper and I think might be getting a little overwhelmed with all the work that needs to be done. They are having a house warming party in two weeks and they have so many things that need to be done. The good friend that I am, I have helped him out with many projects after work and on the weekends…

Lately, I have been helping out my good friend get his new house into shape. He bought a fixer upper and I think might be getting a little overwhelmed with all the work that needs to be done. They are having a house warming party in two weeks and they have so many things that need to be done. The good friend that I am, I have helped him out with many projects after work and on the weekends…Taking the Plunge: 1 Year Quitiversary!!!

– frugalrules.com

Happy Monday everyone! If you’ve been a reader of Frugal Rules for very long you know already that Mrs. Frugal Rules and I run our own advertising and copywriting business. In all fairness, Mrs. Frugal Rules started this little venture into entrepreneurship just over three years ago and as of this past Saturday I have been at this ‘running a business’ thing for one year now! I remember spending several years in a job where I was expected to sell bad financial products to elderly clients and had the “pleasure” of sitting next to someone who thought it was cool to groom himself while at the office and thinking there HAD to be more…

Avoiding the Impluse Buy: How to Buy New Stuff After Getting Out of Debt

– eyesonthedollar.com

Being in debt pay off mode can be a bit isolating. When you are serious about a goal like getting out of credit card debt, you don’t allow yourself to spend money on things that aren’t necessities. If you stick to your goal, it sometimes takes a long time to get rid of the debt, but it does happen…

Being in debt pay off mode can be a bit isolating. When you are serious about a goal like getting out of credit card debt, you don’t allow yourself to spend money on things that aren’t necessities. If you stick to your goal, it sometimes takes a long time to get rid of the debt, but it does happen…Are you jealous of other people’s net worth?

– dinksfinance.com

Good morning Dinks. Do you love reading posts about other people’s net worth? If you answered yes let me ask you a question – why? I used to think that bloggers posting about their net worth was a dumb reason for a post because it seemed like they were bragging, but then as I read more and more posts about peoples net worth I found them to be very motivating because behind the bottom line financial bloggers are actually sharing their success stories of how they made their millions…

Find out Which Gold Coin Suits Your Goals!

– doablefinance.com

Buying a specific type of gold coin every year and make a collection out of it is a hobby nurtured by many. Many people buy gold neither for wearing nor for investment purposes, but they find collecting gold coins a matter of pride. When you are buying gold coins for collection, you will want them ….

Knocking Down the Student Loan Debt – June 2013

– moneylifeandmore.com

We Don’t Owe $278k, But We Still Owe a Lot!

We Don’t Owe $278k, But We Still Owe a Lot!If you’re new to Money Life and More, in December 2012 we decided it was time to open up to you, my readers, and shared our very first debt update.

Student Loan Debt Update – June 2013

June was another interesting month for us. Tori, my fiancee, is still using her short term disability insurance since she can’t even walk at this point…

How Much Are Rising Mortgage Interest Rates Costing You?

– commoncentswealth.com

With mortgage rates at all-time lows, it’s tough to imagine them going any lower. Being that they most likely won’t go lower, that means there is only one direction for them to go… up. I feel like interest rates are talked a lot about when it comes to credit cards and paying off debt, but their impact isn’t widely discussed when buying or selling a home…

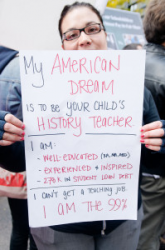

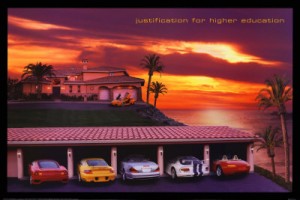

Are Rich People Smarter than You?

– weonlydothisonce.com

Are people who are rich smarter than you?

Are people who are rich smarter than you?I grew up thinking that rich people were smarter than me. It’s hard to remember why I thought this way. After all, my parents sure didn’t drill the thought into me, but school and television very well may have.

When I was in middle school, one of my teachers had this poster on his wall:

I am sure that had something to do with it…After all, I bought a Porsche with a Masters Degree!

Either way, not much has changed to this day: many people actually believe that rich people are a heck of a lot smarter than the rest of us…

If credit cards are getting the best of you, something’s wrong

– johnnymoneyseed.com

I’m totally getting this card for my daughters when they’re 5! Yay Captain Toothpaste!

I’m totally getting this card for my daughters when they’re 5! Yay Captain Toothpaste!Recently, the Atlantic had published an opinionated article, telling us all why credit cards are making us bad people. The author supports his claims with a decent amount of scientific research on the topic that “proves the concept” that credit cards can make you spend more money, which in turn makes you a bad person…