How to Host a Fabulous Party For Free

– studentdebtsurvivor.com

This weekend the bf and I hosted a Cinco De Mayo Qdoba House Party. Sadly a lot of our friends were out of town for the weekend, but we were able to round up 9 hungry guests who were thrilled to try out Qdoba catering, play a little pin the tail on the donkey and drink a few (OK many, Margaritas).

A Little FYI On House Party:

What is House Party? If you’re not familiar with the, “house party model”, the parties are sponsored by companies who give you products, a “Party Pack” of their products to eat/use/try/share…

25 Personal Finance Resources Every College Grad Should Read

– doughroller.net

Photo: fotobydave

So you just graduated from college, and you have no idea where to start when it comes to managing your personal finances. Or maybe you’re fairly good at budgeting, but you need to know about investing. Either way, this list of resources will more than cover all your financial questions, from budgeting basics to buying a home to landing a great-paying career…

How Much House Can You Afford?

– savvyfinanciallatina.com/#&panel1-

We are, currently, saving up for our first home’s down payment. Our goal is to have $50,000 in savings by the time we start looking for a home. $30,000 will be for our down payment, and $20,000 is our general savings account. I have projected to be at our target by September. Right now, we have $36,500, and we are only $13,500 away from our goal…

How to Check Your Credit Report (and Correct the Mistakes)

– theamateurfinancier.com/blog/

I received some less than pleasant news yesterday: GE Capital Retail Bank, the creditor behind my Mastercard, is planning to decrease my credit limit to the higher of my current outstanding debt or $500. This, in and of itself, is not that bad of a thing; I have actually been considering canceling that account when it has been paid off, to try to avoid adding more debt in the future…

I received some less than pleasant news yesterday: GE Capital Retail Bank, the creditor behind my Mastercard, is planning to decrease my credit limit to the higher of my current outstanding debt or $500. This, in and of itself, is not that bad of a thing; I have actually been considering canceling that account when it has been paid off, to try to avoid adding more debt in the future…The Biggest Financial Mistakes I’ve Made in My Career (So Far)

– ayoungpro.com

SourceSince I have a history of revealing secrets, I thought I’d let you in on another one: I’m not perfect. I know, hard to believe right? One of the reasons I wanted to start this blog is to be able to share lessons I learn while learning to become a professional. That means I will share the good and the bad; the mistakes and the successes…

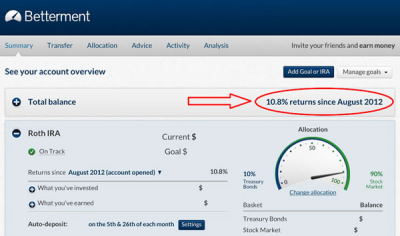

SourceSince I have a history of revealing secrets, I thought I’d let you in on another one: I’m not perfect. I know, hard to believe right? One of the reasons I wanted to start this blog is to be able to share lessons I learn while learning to become a professional. That means I will share the good and the bad; the mistakes and the successes…Betterment Investing Update – Roth IRA

– debtroundup.com

It has been nine months since I started my Roth IRA account over at Betterment. I chose this option because at the time, I just didn’t have much to invest with. I had just paid off my last credit card and just wanted to get started right away. There are a few other great investing options that I like better than Betterment, but there is nothing easier…

It has been nine months since I started my Roth IRA account over at Betterment. I chose this option because at the time, I just didn’t have much to invest with. I had just paid off my last credit card and just wanted to get started right away. There are a few other great investing options that I like better than Betterment, but there is nothing easier…Grow Your Career to Achieve Financial Independence Faster: Part 2

– myfijourney.com

Welcome to the next part of our career development series. We’ve already covered the rules of the working world. Now, we’ll begin delving into specific activities that will help grow your career. Specifically, we’ll focus on how to document our achievements and how to ensure that we look good and that people like us…

Welcome to the next part of our career development series. We’ve already covered the rules of the working world. Now, we’ll begin delving into specific activities that will help grow your career. Specifically, we’ll focus on how to document our achievements and how to ensure that we look good and that people like us…How to Reclaim Your Life from Clutter

– weonlydothisonce.com

For years my family and I have traveled to Vermont to work at our camp. We leave behind the large NJ home and live in a 1100 square foot cottage with our two kids and our dog.

For years my family and I have traveled to Vermont to work at our camp. We leave behind the large NJ home and live in a 1100 square foot cottage with our two kids and our dog.Our strategy for packing is straightforward: Minimal clothing, furnishings, and stuff. Everything fits in the back of our car (mind you, our house in VT is modestly furnished already)…

Your Chance to Win a Sweet Sony 50″ LED TV

– moneylifeandmore.com

Another month and we have another awesome giveaway to tell you about. This month you can win one of these sweet 50″ LED TVs. What would you need (or more appropriately, want) a sweet 50″ LED TV for?

Another month and we have another awesome giveaway to tell you about. This month you can win one of these sweet 50″ LED TVs. What would you need (or more appropriately, want) a sweet 50″ LED TV for?To watch TV of course! As you know, I’m a huge fan of my cable and I’m not going to be cancelling my cable anytime soon…

How to Avoid Ancillary Fees from Airlines

– edwardantrobus.com

(Photo credit: Wikipedia)

(Photo credit: Wikipedia)Last week, Denver-based Frontier headlines made the news with a new fee for carry-on luggage. But only if you book your ticket through an online travel agent such as Hotwire or Orbitz. This is the latest in a march of ancillary fees from airlines to try to increase revenue as their costs increase…

Summer travel no-nos

– dinksfinance.com

It’s spring time, or at least it’s supposed to be. Up here in the cold north east it seems as if winter has been here forever and the warm weather is never going to get here. Let me as you a question Dinks, have you already started planning your summer vacation?

I personally don’t like to travel in the summer because it’s too hot; I much prefer to travel in April or May and in September or October…

Don’t Go Broke Fixing Your Car!

– couplemoney.com

I mentioned that maintaining your car is financially important as car emergencies can ruin a family’s budget quite easily. For couples looking at paying down debt, investing more for their future, or saving up for a paid for vacation, it can be incredibly frustrating to see huge expenses come up with their cars…

5 Great Ways to Save Money When Buying a New Car

– frugalrules.com

The mere thought of visiting an auto dealership twists many would-be car shoppers’ stomachs into knots. Blame pre-conceived notions of working with a car salesperson if you want, or the high price tag that comes with buying a new car. Whether you’re shopping for a new or used car, it’s a major purchase and it’s always made me nervous…

Living on Unemployment: Mission Impossible?

– clubthrifty.com

Living on Unemployment: Mission Impossible?

Living on Unemployment: Mission Impossible?Club Thrifty – Stop spending. Start living.While we are enjoying our vacation, please check out this guest post from Daniel Hilsden from Money Saving Angels. If you are interested in guest posting at Club Thrifty, please see our guest posting guidelines.

Could you afford to support yourself on unemployment benefits alone?

Being and becoming unemployed is more of a reality than ever for millions of Americans…

Borrow or Lend As Little As $25 With The Help Of Kiva

– doablefinance.com

There are many programs about peer-to-peer micro-lending, one of which is Kiva.org that’s still in business. Another one is Virgin Money (VM) but it’s closed to the U.S. market. VM serves only UK, Australia and South Africa. Kiva is open to all. Kiva is a nonprofit organization that promotes itself as a link between small …

Dave Ramsey’s Baby Step 7: Build Wealth and Give

– commoncentswealth.com

Now that you’ve made it through the hardest parts of the program, step 7 is the most fun and easiest. Let’s just do a little recap on what needed to be done to make it this far. You started with a little emergency fund, then you paid off all debt besides the mortgage, then you built up a fully-funded emergency fund of 3-6 months of expenses, then you started putting 15% towards retirement and saving for your children’s college, then you finally made it through step 6 by paying off your mortgage…