Telus Corp (T) is getting ready for its 2 for 1 split. Are you ready?

– myfirst50000.com

Tomorrow, it will happen. For the first time in its history, Telus is going to split! I am quite exciting by this. I had experiment not split but roll over, like 8 to 1 in the case of DNI Metals (DNI) and also BNT. In both cases, following the roll over, the stock had gained in value. Will Telus split stocks will gain in fabulous value? That’s what we are going to watch out for tomorrow and in the days to come…

CVS Caremark Now #40 Largest Company, Surpassing American Express

– forbes.com/sites/dividendchannel

In the latest look at the underlying components of the S&P 500 ordered by largest market capitalization, CVS Caremark Corporation (NYSE: CVS) has taken over the #40 spot from American Express Co. (NYSE: AXP), according to The Online Investor. Click here to find out the top S&P 500 components ordered by average analyst rating »

In the latest look at the underlying components of the S&P 500 ordered by largest market capitalization, CVS Caremark Corporation (NYSE: CVS) has taken over the #40 spot from American Express Co. (NYSE: AXP), according to The Online Investor. Click here to find out the top S&P 500 components ordered by average analyst rating »Portfolio Update Q1

– thedividendguyblog.com

I don’t know about your stock portfolio, but mine has been showing great results in 2013. I’m obviously not as good as my 2013 Best Dividend Stock Book as I don’t hold all of them, but I’m still pretty happy with my results so far. After the first quarter, it’s time to look at my positions and look forward to the future…

Capitol Federal Financial (CFFN) Declares $0.075 Quarterly Dividend; 2.5% Yield

– streetinsider.com

Visit StreetInsider.com at http://www.streetinsider.com/Dividends/Capitol+Federal+Financial+%28CFFN%29+Declares+%240.075+Quarterly+Dividend%3B+2.5%25+Yield/8258991.html for the full story.

High Yield Dividend Investing Misconceptions

– dividendgrowthinvestor.com

One of the biggest misconceptions about dividend investing out there is that investors should change their strategy, depending on their age. I believe that this misconception comes from the traditional world of retirement planning, where advisers told clients to allocate higher and higher amounts to fixed income instruments as they got older…

Recent Buy

– dividendmantra.com

Enter the fire! I love days like this past Monday, when the S&P 500 fell more than 2%. Although not a noticeable pullback on its own, there were quite a few equities on my watch list, and in my own portfolio, that fell much further than this. Drops of 4-5% or more in one day tend to get my attention, and I love few things more in life than getting a piece of a high quality company when its on a fire sale…

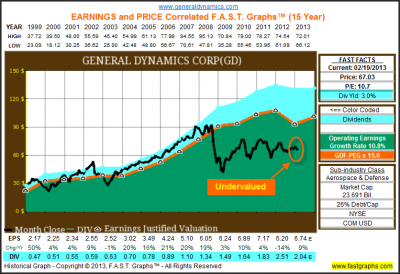

General Dynamics Corp: Fundamental Stock Research Analysis

– thediv-net.com

Before analyzing a company for investment, it’s important to have a perspective on how well the business has performed. Because at the end of the day, if you are an investor, you are buying the business. The FAST Graphs™ presented with this article will focus first on the business behind the stock…

Before analyzing a company for investment, it’s important to have a perspective on how well the business has performed. Because at the end of the day, if you are an investor, you are buying the business. The FAST Graphs™ presented with this article will focus first on the business behind the stock…Dividend Stocks are Not a Bond Substitute

– dividendninja.com

The following is a guest post by Ben Carlson from A Wealth of Common Sense

The following is a guest post by Ben Carlson from A Wealth of Common Sense“Compare this with a 50% drawdown in stocks in the past bear market and you can see that bonds and stocks do not have the same characteristics for loss. Interest rates would really need to spike higher in a very short period of time to equal stock losses…

Limited Supply Of Above Average Dividend Stocks

– dividends4life.com

We did a simple screen today for dividends stocks that are simply above average on several key parameters, and only found two. We never cease to be surprised at how difficult it is to quantitatively find stocks that pass seemingly quite reasonable requirements. The two we found, in fact may not be the best choices, but they are the only ones that met these simple criteria used after the close

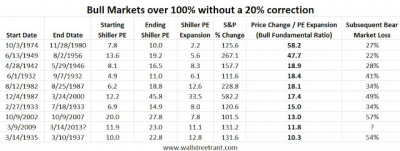

Are You Ready For The Next Market Crash?

– intelligentspeculator.net

The other day I read a very interesting piece of data… if you look at the US markets over the past century or so, every strong rally has had some kind of dip at some point. There have been a dozen or so times where the markets have increased by 100% without a 20% setback. Just look at this chart:

The other day I read a very interesting piece of data… if you look at the US markets over the past century or so, every strong rally has had some kind of dip at some point. There have been a dozen or so times where the markets have increased by 100% without a 20% setback. Just look at this chart:

Now take a look at that last column… At some point, we will have a major correction…