A Very Expensive Vacation Without A Tan Or Beach Photos To Show For It

– solvingthemoneypuzzle.com/

I am back to work after a week of vacation that was too short and too expensive. They say bad things come in 3 and I had my 3 in my 1 small week of vacation and it all started the week after I signed up for a new HELOC repayment plan that requires me to pay $400 biweekly whether I have the money or not…

I am back to work after a week of vacation that was too short and too expensive. They say bad things come in 3 and I had my 3 in my 1 small week of vacation and it all started the week after I signed up for a new HELOC repayment plan that requires me to pay $400 biweekly whether I have the money or not…17 Ways to Slash Your Water Bill

– moneytalksnews.com

More than a million miles of water pipes in the U.S. will be in need of repair between now and 2035, says the American Waterworks Association. The cost of those repairs will top $1 trillion, and will largely be funded by your water bill.Depending on where you live, your water bill could increase a lot…

More than a million miles of water pipes in the U.S. will be in need of repair between now and 2035, says the American Waterworks Association. The cost of those repairs will top $1 trillion, and will largely be funded by your water bill.Depending on where you live, your water bill could increase a lot…Is There Someone For Everyone? In Search For Love In Chaos

– financialsamurai.com

Seven billion people in the world are split 50/50 between women and men. Surely there’s someone out there for us all? Maybe we get it wrong the first 10 people we date. Or maybe we think we get it right the first try only to end up divorcing several years later. Whatever the case may be, I believe there are multiple “the ones” out there for us to find…

Seven billion people in the world are split 50/50 between women and men. Surely there’s someone out there for us all? Maybe we get it wrong the first 10 people we date. Or maybe we think we get it right the first try only to end up divorcing several years later. Whatever the case may be, I believe there are multiple “the ones” out there for us to find…Ask the Readers: Do You Have Side Income?

– wisebread.com

One common tip for achieving financial security is to make sure you have other sources of income outside your primary job. Some people do side gigs on their off hours, while others find ways to generate passive income to help them earn money without too much work…

3 Ways to Use Your Credit Card to Improve Your Finances

– financialhighway.com/

We’re so used to hearing about how credit cards pave the road to financial catastrophe that we don’t often think about how they might actually be able to help our finances.While it’s true that credit card debt can devastate your finances, there is a good side to the credit card coin…

We’re so used to hearing about how credit cards pave the road to financial catastrophe that we don’t often think about how they might actually be able to help our finances.While it’s true that credit card debt can devastate your finances, there is a good side to the credit card coin…Own Dividend Stocks? Don’t Forget about the Dividend Tax Credit

– canadianfinanceblog.com

One of the ways you can build an investment income stream is through the use of dividend stocks. When you own dividend stocks, you receive an extra payout from the company. This payment is a portion of the company’s profits, and is above and beyond capital appreciation. As long as you own shares in the company, you receive dividends…

One of the ways you can build an investment income stream is through the use of dividend stocks. When you own dividend stocks, you receive an extra payout from the company. This payment is a portion of the company’s profits, and is above and beyond capital appreciation. As long as you own shares in the company, you receive dividends…5 Smart, Inexpensive Summer Vacations

– moneysmartlife.com

Schools have emptied and the hot weather is here. This time of year is very popular for vacations. With the way of the current economy however, not every person has the financial resources to take the trip away that they need. Everybody deserves a break in order to re-charge from daily life. Perhaps some of these ideas will strike a chord and give people an idea for their time off that will allow them to save some money…

Schools have emptied and the hot weather is here. This time of year is very popular for vacations. With the way of the current economy however, not every person has the financial resources to take the trip away that they need. Everybody deserves a break in order to re-charge from daily life. Perhaps some of these ideas will strike a chord and give people an idea for their time off that will allow them to save some money…The $150 “Back to School” Target Giveaway!

– budgetsaresexy.com/

I know I know, it’s not time to go back to school quite *yet*, but my sources say people go shopping for this kinda stuff earlier than later 😉 So today we’re helping THREE of you get on the ball nice and early too with a $50 Target gift card a piece! Makin’ it rain all gift card style! Haha…

And of course I’m partnering up with my good friends over at RetailMeNot…

Should You Relocate to Save Money?

– moneyning.com/

The basic cost of living in some cities, like New York City, is almost double the $7.25 minimum wage. Double. How can anyone survive like that?

Well, thanks to technology, you don’t have to. More and more people are adopting the concept of “location independence,” or working remotely from anywhere…

5 Tips To Make a Road Trip Affordable, Fun, and Totally Epic

– youngadultmoney.com/

Today we have a post from our regular contributor Kyle James. Enjoy!

Having just returned from a 2-week road trip with my wife and 3 kids I can honestly say that it was “the best of times, and the worst of times.” We visited some amazing places like the Grand Canyon, Mesa Verde and Zion National Park but it wasn’t without incident…

Having just returned from a 2-week road trip with my wife and 3 kids I can honestly say that it was “the best of times, and the worst of times.” We visited some amazing places like the Grand Canyon, Mesa Verde and Zion National Park but it wasn’t without incident…

My Budget Breakdown (For The First Time!)

– budgetblonde.com

It’s kind of hard to believe that I’ve never really shared a budget breakdown on this blog.

It’s kind of hard to believe that I’ve never really shared a budget breakdown on this blog.I guess I’ve been comfortable telling you about all of my money mistakes and my credit card debt (that I eventually paid off.) I’ve even blabbed about the six figure student loan debt that the hubs and I face daily, and I have tracked my spending for a week and shown you too…

Is there morality in personal finance?

– getrichslowly.org/blog

This post is from staff writer Kristin Wong. A while back, my blogger friend and fellow GRS writer Holly Johnson wrote about a healthy dose of lifestyle inflation. In that article, someone made a side point that there shouldn’t be morality in personal finance — it should be about practicality…

A New College Student’s Guide to Saving Money on Campus

– thesimepledollar.com

It wasn’t all that long ago that I was enjoying that special summer between high school and college. I had graduated from high school, of course, but I was also the first person in my family to actually attend college. It was exciting and a bit frightening and almost overwhelming.

Looking back now on my journal entries from that time and recalling the choices I made, I recognize how completely inefficient I was in those first years in school…

Looking back now on my journal entries from that time and recalling the choices I made, I recognize how completely inefficient I was in those first years in school…

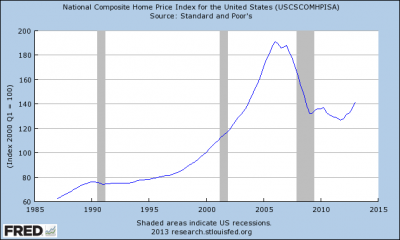

The Cost of Housing & why it Can Make or Break your Finances

– 20somethingfinance.com/

Health care is a wrap in the Summer of Saving series, and it’s time to move on to the BIG ONE: housing costs.

Health care is a wrap in the Summer of Saving series, and it’s time to move on to the BIG ONE: housing costs.Realtors are paid to tell us “It’s a great time to buy a home” (in fact, I remember an ad campaign recently with just that slogan…), “You deserve it!”, and “You should probably offer more than asking price, so you don’t lose the the house to another bidder”…

Reader Profile: KP

– freemoneyfinance.com

The following is the latest post in my “Reader Profiles” series. Each post in this series details the financial situation and challenges of an FMF reader. The purpose of this series is to help us all identify with people like us (in similar situations — not all will be, of course, but eventually I’m sure you will find someone like you here), get to know the frequent commenters on the site, and hear some financial wisdom/challenges from people other than me…

A Breakdown of Our Monthly Expenses 2013

– milliondollarjourney.com

Back in 2008, I wrote a post about our monthly expenses. Since a lot has happened over the past 5 years or so, I thought it would be a good idea to provide an update.

So what has happened since 2008? To start, in 2008 we had our first child (expenses were not included in the previous post), and we built a new house…

So what has happened since 2008? To start, in 2008 we had our first child (expenses were not included in the previous post), and we built a new house…

Why I Use Cash

– prairieEcothrifter.com

As I read financial blogs, I find that a lot of bloggers seem to like to pay for everything with their credit card. Why not, they ask? You can get rewards or cash back, the credit card company tracks all your purchases for you and may even show you a yearly statement indicating the percents you spent on that card in various categories…

Now that I have a high enough credit score to take advantage of certain deals, I’ve been hard at work piling up the rewards. My wife and I have had a lot of expenses in the last few months (between a sick puppy and an October due baby girl) and while I’ve been able to pay off the balances every month, we’re at the point where it’s time to take advantage of a nice interest-free loan…

Now that I have a high enough credit score to take advantage of certain deals, I’ve been hard at work piling up the rewards. My wife and I have had a lot of expenses in the last few months (between a sick puppy and an October due baby girl) and while I’ve been able to pay off the balances every month, we’re at the point where it’s time to take advantage of a nice interest-free loan…Variable Annuities Customers Facing Benefit Reductions

– consumerismcommentary.com/

When people find out I’ve been writing a blog about personal finance for ten years — yes, it seems crazy, but the tenth anniversary of Consumerism Commentary is Tuesday — they recognize it is an opportunity to share their financial troubles and triumphs. I’m a good listener. For the most part, I am happy to hear what others have to say but will only reluctantly share my opinion about the choices they’ve made…

When people find out I’ve been writing a blog about personal finance for ten years — yes, it seems crazy, but the tenth anniversary of Consumerism Commentary is Tuesday — they recognize it is an opportunity to share their financial troubles and triumphs. I’m a good listener. For the most part, I am happy to hear what others have to say but will only reluctantly share my opinion about the choices they’ve made…