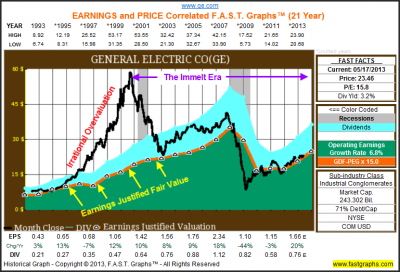

General Electric Looks Like It’s Becoming The Shareholder-Friendly Company It Once Was

– thediv-net.com

General Electric (GE) was once revered as one of the bluest of all blue-chip companies in the world. During its glory days, GE was respected as an industrial conglomerate that manufactured some of the world’s best jet engines, locomotives, appliances and even the highly regarded General Electric light bulb…

General Electric (GE) was once revered as one of the bluest of all blue-chip companies in the world. During its glory days, GE was respected as an industrial conglomerate that manufactured some of the world’s best jet engines, locomotives, appliances and even the highly regarded General Electric light bulb…Carnival Corp. (CCL) Declares $0.25 Quarterly Dividend; 3.1% Yield

– streetinsider.com

Visit StreetInsider.com at http://www.streetinsider.com/Dividends/Carnival+Corp.+%28CCL%29+Declares+%240.25+Quarterly+Dividend%3B+3.1%25+Yield/8389583.html for the full story.

Why do I analyze dividend stocks that are not buys?

– dividendgrowthinvestor.com

I have the terrible habit of analyzing companies that I never plan on investing into. That makes many readers furious, and possibly angry enough to stop reading my blog. While I do try to focus on the best dividend stocks in order to generate a rising dividend income for life, I sometimes focus on companies which are not good enough for me…

Top 100 Dividend Stocks – June 2013 Edition

– intelligentspeculator.net

Dividend investing is a huge part of my investment strategy. As I’ve mentioned in my now monthly passive income updates, receiving dividend income from my both my Ultimate Sustainable Dividend portfolio and my ETF portfolio is a primary driver of how my retirement will be like a few decades from now:)

Dividend investing is a huge part of my investment strategy. As I’ve mentioned in my now monthly passive income updates, receiving dividend income from my both my Ultimate Sustainable Dividend portfolio and my ETF portfolio is a primary driver of how my retirement will be like a few decades from now:)Today I’m looking at the top S&P500 dividend stocks…

CG Crosses Below Key Moving Average Level

– forbes.com/sites/dividendchannel

In trading on Tuesday, shares of Carlyle Group, L.P. (NASD: CG) crossed below their 200 day moving average of $28.43, changing hands as low as $27.65 per share. Carlyle Group, L.P. shares are currently trading down about 4.4% on the day. The chart below shows the one year performance of CG shares, versus its 200 day moving average:

Recent Buy

– dividendmantra.com

Well guys, I’m doing the best I can in this market. I’m not seeing a ton of compelling opportunities out there, but I do see that Real Estate Investment Trusts as a group have taken quite a tumble lately. It could be due to a rotation out of higher yielding securities and into cyclical plays, or it could be that the Federal Reserve Chairman, Ben Bernanke, has hinted toward a tapering of QE if the economy continues to improve (which could cause interest rates to rise)…

So Long and Thanks for All the Fish! (Taking a Break)

– dividendninja.com

On September 12th, 2010, The Dividend Ninja began as a small WordPress site about dividend investing. My main goal was to learn how to integrate WordPress alongside other development platforms. Blogging about my new found love of dividend stocks was also fun!

On September 12th, 2010, The Dividend Ninja began as a small WordPress site about dividend investing. My main goal was to learn how to integrate WordPress alongside other development platforms. Blogging about my new found love of dividend stocks was also fun!Little did I know that things would unfold so quickly, and that the research and effort I was putting into my articles would be of interest to so many others…

Cheap Dividend Paying Large Cap

– dividends4life.com

The markets getting more expensive and my research for real bargains or cheap valuated stocks rise. Today I like to use my monthly screen of the cheapest large capitalized stocks. Buy low and sell high is the basic philosophy behind. But its very difficult to know when stocks are cheap. In markets that are going up for years, the only reason to find cheap stocks is to look at the future growth…