Goldman Sachs Group, Inc. (GS) Declares $0.50 Quarterly Dividend; 1.2% Yield

– streetinsider.com

Visit StreetInsider.com at http://www.streetinsider.com/Dividends/Goldman+Sachs+Group%2C+Inc.+%28GS%29+Declares+%240.50+Quarterly+Dividend%3B+1.2%25+Yield/8502924.html for the full story.

2013 Top Dividend Stocks

– dividends4life.com

With the first half of 2013 in the books, it’s time to evaluate what has been going on in the world of stocks. Year to date, the Dow Jones Industrials Index is up 13.78%, S&P 500 is up 12.63%, and the Nasdaq is up 12.71%, which are pretty good gains considering the selling that has been going on lately…

How to Increase Current Yields with Master Limited Partnerships

– dividendgrowthinvestor.com

As a buy and hold investor, I usually refrain from selling, unless there is something drastic like a dividend cut. Over the past year however, I have tried to sell some legacy positions, which either didn’t perform well or were overvalued with similar companies available at cheaper prices. The transaction I did last week was an example of this, as I replaced a position with other similar…

The Challenges Of Retiring In A Low/Zero Interest Environment

– intelligentspeculator.net

Over the past few days, I have been looking at retirement and different problems and solutions involved. One of the major problems for recent or near future retirees is the fact that interest rates have been at record lows. In fact, you can barely call them interest rates I guess because they have been near 0% for months now…

Over the past few days, I have been looking at retirement and different problems and solutions involved. One of the major problems for recent or near future retirees is the fact that interest rates have been at record lows. In fact, you can barely call them interest rates I guess because they have been near 0% for months now…Asset Allocation Recap and Eye on my 2013 Investing Goals

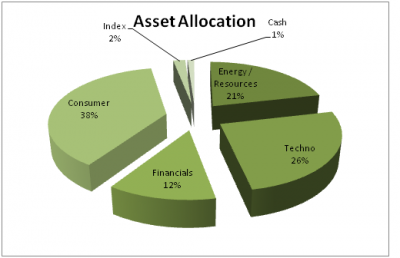

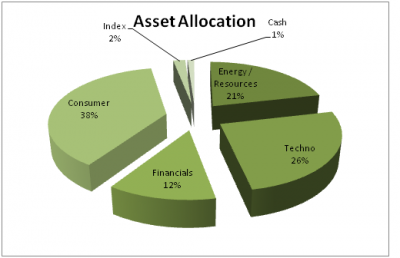

– thedividendguyblog.com

Summer time is a great time for investor to take a moment as it marks a relative pause in the stock market. The stock market continues to go up and down but we all have more time to think about our investments as vacations approach. I also like to take a look at my portfolio after 6 months to verify my performance and see where I’m going and if I’m aligned with my investing goals…

Summer time is a great time for investor to take a moment as it marks a relative pause in the stock market. The stock market continues to go up and down but we all have more time to think about our investments as vacations approach. I also like to take a look at my portfolio after 6 months to verify my performance and see where I’m going and if I’m aligned with my investing goals…Mid-Year Goals Review

– dividendmantra.com

At the beginning of the year I laid forth my goals for 2013. I wanted to put a list of goals together that would be challenging, actionable and measurable. I believe that to various degrees all four goals meet this criteria.

medianet_width=’728′; medianet_height= ’90’; medianet_crid=’471230276′;

With half of 2013 now behind us I thought now would be a good time to review these goals and see if I’m on track to exceed them…

What I Look For In A Dividend Stock

– thediv-net.com

Many of my readers have asked me to write about how I choose which dividend stock to invest in. I’ve been a little hesitant to write this post because well, I don’t want to be held liable for anyone’s decision to invest their money. Also some of my metrics might seem too simple to some investors…

Many of my readers have asked me to write about how I choose which dividend stock to invest in. I’ve been a little hesitant to write this post because well, I don’t want to be held liable for anyone’s decision to invest their money. Also some of my metrics might seem too simple to some investors…Reinsurance Group of America Moves Up In Market Cap Rank, Passing QEP Resources

– forbes.com/sites/dividendchannel

In the latest look at stocks ordered by largest market capitalization, Russell 3000 component Reinsurance Group of America, Inc. (NYSE: RGA) was identified as having a larger market cap than the smaller end of the S&P 500, for example QEP Resources Inc (NYSE: QEP), according to The Online Investor…

Wells Fargo & Co. (WFC) Stock Analysis

– dividendmonk.com/

-Seven Year EPS Growth Rate: 5.9%

-Seven Year EPS Growth Rate: 5.9%-Seven Year Dividend Growth Rate: Negative

-Current Dividend Yield: 2.81%

-Credit Rating: AA- / A2 / A+ (high)

Wells Fargo appears fair in the low-to-mid $40′s, and is set to offer a substantially higher dividend over the next few years.

Overview

Wells Fargo & Co (NYSE: WFC) is one of the largest four banks in the United States, with its specific ranking depending on the metric used…

What Are Dividend Aristocrats And How To Profit From Them

– thedividendpig.com

Dividends are like the third rail for public companies. Most board members and executives would much rather do something drastic like borrow money instead of reducing their dividend payments to shareholders. So, there is something to be said for dividend aristocrats who continue raise their dividends year in and year out…

Dividends are like the third rail for public companies. Most board members and executives would much rather do something drastic like borrow money instead of reducing their dividend payments to shareholders. So, there is something to be said for dividend aristocrats who continue raise their dividends year in and year out…