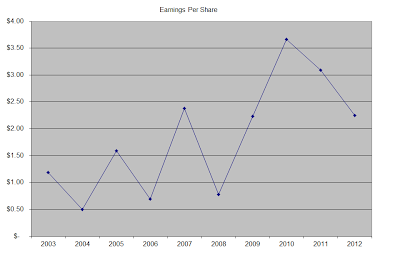

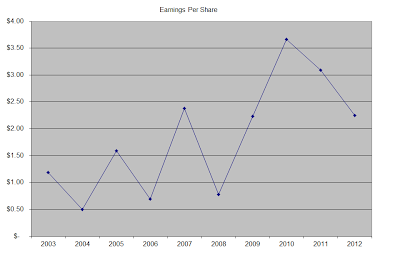

Teva Pharmaceutical (TEVA) Dividend Stock Analysis

– dividendgrowthinvestor.com

Teva Pharmaceutical Industries Limited develops, manufactures, markets, and distributes pharmaceutical products worldwide. This dividend achiever has paid dividends since 1984, and has increased them for 13 years in a row.

The company’s last dividend increase was in February 2013 when the Board of Directors approved a 25% increase in the quarterly distribution to 1 NIS /share…

Pathfinder Bancorp, Inc. (PBHC) Declares $0.03 Quarterly Dividend; 0.9% Yield

– streetinsider.com

Visit StreetInsider.com at http://www.streetinsider.com/Dividends/Pathfinder+Bancorp%2C+Inc.+%28PBHC%29+Declares+%240.03+Quarterly+Dividend%3B+0.9%25+Yield/8459767.html for the full story.

Teva Pharmaceutical Stock Analysis

– thediv-net.com

Teva Pharmaceutical Industries Limited develops, manufactures, markets, and distributes pharmaceutical products worldwide. This dividend achiever has paid dividends since 1984, and has increased them for 13 years in a row.

Teva Pharmaceutical Industries Limited develops, manufactures, markets, and distributes pharmaceutical products worldwide. This dividend achiever has paid dividends since 1984, and has increased them for 13 years in a row.

The company’s last dividend increase was in February 2013 when the Board of Directors approved a 25% increase in the quarterly distribution to 1 NIS /share…

Don’t Give Up on Dividend Stocks

– dividends4life.com

The whole-grain goodness of blue-chip dividend stocks has its limits. Utility stocks, consumer staples, pipelines, telecoms, and REITs have all lost ground over the past month, even while the broader market has been flat. With the bond market signaling an expectation of rising interest rates, the five-year rally for steady blue-chip dividend payers has stalled…

Weekend Readings – What’s Going On In Wimbledon?

– intelligentspeculator.net

I am a big tennis fan and Wimbledon is clearly a unique event in so many ways. I know a few of you have been watching.. I still can’t believe all of those early losses.. Federer, Nadal and so many others… it’s been a memorable first week! Now hoping to see a Murray-Djokovic final… and maybe a couple more wins for Eugenie Bouchard?:)

I am a big tennis fan and Wimbledon is clearly a unique event in so many ways. I know a few of you have been watching.. I still can’t believe all of those early losses.. Federer, Nadal and so many others… it’s been a memorable first week! Now hoping to see a Murray-Djokovic final… and maybe a couple more wins for Eugenie Bouchard?:)General Readings

-Why is it so hard to hire great people? @ TheAtlantic

-Insiders are buying and that’s good news @ Marketwatch

-Why aren’t the top journalists rich? @ Priceonomics

-Investors running out of the bond market @ NYT

Dividend Readings

-Stocks beyond numbers – 5 golden rules @ TheDividendGuyBlog

-Waste management unappealing for 2013 @ DividendMonk

Tech Stock Readings

-Is Mark Zuckerberg the new Bill Gates? @ PandoDaily

The post Weekend Readings – What’s Going On In Wimbledon? appeared first on Intelligent Speculator.

Oracle Moves Up In Market Cap Rank, Passing Philip Morris International

– forbes.com/sites/dividendchannel

In the latest look at the underlying components of the S&P 500 ordered by largest market capitalization, Oracle Corp. (NASD: ORCL) has taken over the #19 spot from Philip Morris International Inc (NYSE: PM), according to The Online Investor. Click here to find out the top S&P 500 components ordered by average analyst rating »

DW 2Q2013 Healthcare S-REITs Review: Riding on an Aging Asia

– dividendsrichwarrior.blogspot.com/

Many countries in Asia are aging at an alarming rate. Governments have been raising the retirement age and also trying desperately to raise the birth rates. People are simply living longer due to advancements in medical technology. This is a major macro-social trend that will not change. I have heard stories that the waiting lists at nursing homes in Singapore are so long, some elderly patients passed away even before they turns come…

Weekend Link Time

– thedividendguyblog.com

Let’s jump right into the links!

1. The Risk-Reward Ratio On Apple Makes It A No-Brainer @ IS.

2. The Ultimate Wealth Building Plan to Be Damn Free by 30 @ Studenomics.

3. Buffet’s Perspective On When To Buy @ Dividend Ladder.

4. Turn the oil and gas flow into a dividend flow @ TDT.

5…

1. The Risk-Reward Ratio On Apple Makes It A No-Brainer @ IS.

2. The Ultimate Wealth Building Plan to Be Damn Free by 30 @ Studenomics.

3. Buffet’s Perspective On When To Buy @ Dividend Ladder.

4. Turn the oil and gas flow into a dividend flow @ TDT.

5…