Cramer's Mad Money – 8 Things To Watch Next Week (3/28/13)

– seekingalpha.com

By SA Editor Miriam Metzinger: Stocks discussed on the in-depth session of Jim Cramer’s Mad Money TV Program, Thursday March 28.

8 Things To Watch Next Week: McCormick (MKC), Monsanto (MON), Conagra (CAG). Other stocks mentioned: Dupont (DD), MetroPCS (PCS), Halliburton (HAL)

On Thursday, the S&P 500 took out its all-time high and the Dow gained 52 points…

8 Things To Watch Next Week: McCormick (MKC), Monsanto (MON), Conagra (CAG). Other stocks mentioned: Dupont (DD), MetroPCS (PCS), Halliburton (HAL)

On Thursday, the S&P 500 took out its all-time high and the Dow gained 52 points…

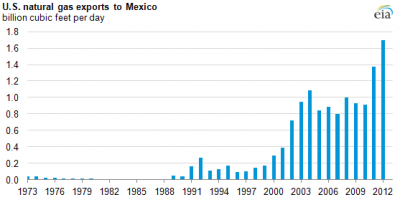

Kinder Morgan (NYSE: KMP) Beating Cheniere (NYSE: LNG) at its Own Game

– http://www.investmentu.com/

The Department of Energy currently has 16 applications on file for companies that want to export liquefied natural gas (LNG). It’s been so overwhelmed with applications it instituted a moratorium on filing them.

The Department of Energy currently has 16 applications on file for companies that want to export liquefied natural gas (LNG). It’s been so overwhelmed with applications it instituted a moratorium on filing them.And one company is beating all the rest. Now if we’re just talking LNG, most investors would correctly guess Cheniere Energy, Inc…

Short list of Pentagon awards adds up to $52.4 million in total funding.

So Who’s Right On Cliffs Natural Resources?

– investopedia

Iron ore and coal producer Cliffs Natural Resources has faced downgrade after downgrade in the face of fallen commodity prices and terrible earnings. However, it did just receive some good news from one investment bank. So teequestion remians- Is there value in the shares?

J2Z’s Pelosky Calls Japan a `Big Opportunity’ (Audio)

– bloomberg.com

March 28 (Bloomberg) — Jay Pelosky, founder of J2Z

Advisory, calls Japan a “big opportunity” for investors and

recommends the WisdomTree Japan Hedged Equity Fund ETF.

Bloomberg Radio’s Catherine Cowdery reports on Exchange Traded

Funds.

Advisory, calls Japan a “big opportunity” for investors and

recommends the WisdomTree Japan Hedged Equity Fund ETF.

Bloomberg Radio’s Catherine Cowdery reports on Exchange Traded

Funds.

Re: Past and Present market history?

– bogleheads.org

Do some reading on secular trends, bull and bear. The market does have decades long periods characterized by one or the other. It is also true that a hundred years of history is enough to show that a hundred years of history is not enough to show how this market behaves in detail. It is also true that a hundred years is not enough to predict many other things that will turn out to be important in our lives over the next twenty, fifty, or a hundred years (except that almost no one alive today will see that last one, but our children may well).

5 Best Steve Jobs Videos for Inspiration and Advice

– http://slant.investorplace.com/

Apple (NASDAQ:AAPL) didn’t just have a whiz-bang CEO in Steve Jobs, it also had a very wise and philosophical man who knew about much more than computers.

Recently I’ve seen a number of Steve Jobs videos making the rounds as investors talk about what Apple is doing wrong, and how the inspiration and advice of its late co-founder could help the corporation move forward…

Recently I’ve seen a number of Steve Jobs videos making the rounds as investors talk about what Apple is doing wrong, and how the inspiration and advice of its late co-founder could help the corporation move forward…

Lockheed Wins Helo Contract; Exelis Will Counter IEDs

– dailyfinance.com

Filed under: Investing

Thursday was a slow day for Pentagon contractors. For the most part, small, privately held companies snapped up the majority of the contracts that were available for the taking. The Department of Defense did, however, announce a pair of small (in defense contracting terms) awards to two publicly traded companies:

Lockheed Martin won $27…

Is This the Perfect Emerging Markets Portfolio?

– streetauthority.com

Although the previous decade heralded the arrival of the BRIC (Brazil, Russia, India and China) nations, the current decade has a new class of emerging markets favored by investors. In fact, those markets, which are also known by a handy acronym — CIVETS (Colombia, Indonesia, Vietnam, Egypt, Turkey and South Africa), have outperformed the BRICs in recent years…

Although the previous decade heralded the arrival of the BRIC (Brazil, Russia, India and China) nations, the current decade has a new class of emerging markets favored by investors. In fact, those markets, which are also known by a handy acronym — CIVETS (Colombia, Indonesia, Vietnam, Egypt, Turkey and South Africa), have outperformed the BRICs in recent years…