ISRG Makes Bullish Cross Above Critical Moving Average

– forbes.com/sites/dividendchannel

In trading on Wednesday, shares of Intuitive Surgical Inc (NASD: ISRG) crossed above their 200 day moving average of $515.72, changing hands as high as $516.07 per share. Intuitive Surgical Inc shares are currently trading up about 0.1% on the day. The chart below shows the one year performance of ISRG shares, versus its 200 day moving average:

Ultimate Sustainable Dividend Portfolio – June 2013 Update – Still Crushing the S&P500

– intelligentspeculator.net

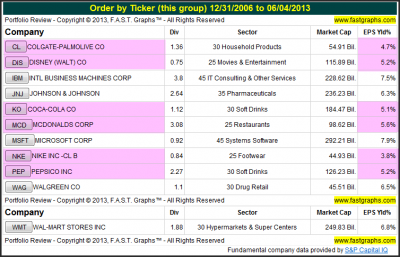

In September 2011, I did some in-depth research to find long term sustainable dividend stocks and have been doing updates on this Ultimate Sustainable dividend portfolio since then in the attempt to show how well such a portfolio can perform over the long term. I would personally say that things have been going very well and will certainly continue to evolve…

In September 2011, I did some in-depth research to find long term sustainable dividend stocks and have been doing updates on this Ultimate Sustainable dividend portfolio since then in the attempt to show how well such a portfolio can perform over the long term. I would personally say that things have been going very well and will certainly continue to evolve…How to crush the market with dividend growth investing

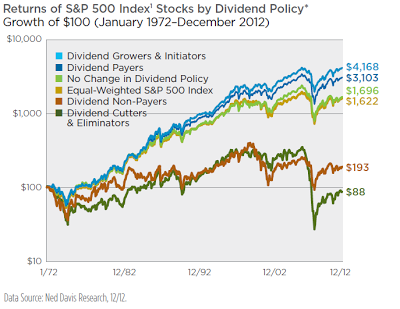

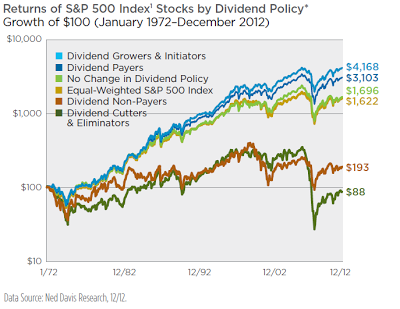

– dividendgrowthinvestor.com

Dividend growth investing is the true underdog of investment strategies. It is not because the strategy fails to generate consistent returns to investors, but because it is not lucrative for the financial industry. It is also misunderstood because it focuses on dividends that grow, not simply yield. Dividend growth investing is a simple investing strategy that focuses on buying and holding quality companies at attractive valuations, which have the potential to increase earnings and dividends along the way…

Dividend growth investing is the true underdog of investment strategies. It is not because the strategy fails to generate consistent returns to investors, but because it is not lucrative for the financial industry. It is also misunderstood because it focuses on dividends that grow, not simply yield. Dividend growth investing is a simple investing strategy that focuses on buying and holding quality companies at attractive valuations, which have the potential to increase earnings and dividends along the way…35 Dividend Growth Stocks by Dan Mac Review

– thedividendguyblog.com

My fellow blogger Dan Mac at Dividend Growth Stock Investing has just launched his first book on Kindle!

I was lucky enough to get a free copy (and I’ve forwarded the link to my newsletter subscribers on Monday so a bunch of my readers got it for free as well!) so I thought it would be a good idea to get the word out…

I'm Not Buying Stocks, I'm Buying Ownership In High Quality Companies

– dividendmantra.com

I’ve been investing surplus capital from carefully saving over 50% of my net income for over three years now. I’ve done this month in and month out, building up my Freedom Fund to a respectable six-figure portfolio that has equity ownership stakes with 35 different high quality companies that pay out dividends, and raise them on a regular basis…

Pinnacle West Capital Corp. (PNW) Declares $0.545 Quarterly Dividend; 4% Yield

– streetinsider.com

Visit StreetInsider.com at http://www.streetinsider.com/Dividends/Pinnacle+West+Capital+Corp.+%28PNW%29+Declares+%240.545+Quarterly+Dividend%3B+4%25+Yield/8432881.html for the full story.

What I’ve Learned From 10 Years Of Dividend Investing

– dividends4life.com

My dividend investing journey has been ongoing for more than 10 years and has had more than the occasional change of direction. From an exploration of high-yield stocks to international dividend-paying stocks and even small- to mid-cap dividend stocks, I have tried a number of ways to grow a high-quality dividend income stream…

Never Fear A Recession Again

– thediv-net.com

The Volatility Is Risk Myth If you were to take the essence of most people’s beliefs and understanding about investing in common stocks, or the stock market for that matter, and turn it into a movie, I believe it would have to be labeled under the category science fiction. In other words, in my experience, most of what people believe about common stocks or the stock market is predicated more on opinion than on fact…

The Volatility Is Risk Myth If you were to take the essence of most people’s beliefs and understanding about investing in common stocks, or the stock market for that matter, and turn it into a movie, I believe it would have to be labeled under the category science fiction. In other words, in my experience, most of what people believe about common stocks or the stock market is predicated more on opinion than on fact…