Gold ETP Holdings Have Record Monthly Drop (Audio)

– bloomberg.com

April 30 (Bloomberg) — Gold holdings in exchange-traded

products plunged 174 metric tons in April, the biggest monthly

drop ever. Jason Toussaint, managing director of investments at

the World Gold Council, comments on the sell-off. Bloomberg

Radio’s Catherine Cowdery reports on Exchange Traded Funds.

products plunged 174 metric tons in April, the biggest monthly

drop ever. Jason Toussaint, managing director of investments at

the World Gold Council, comments on the sell-off. Bloomberg

Radio’s Catherine Cowdery reports on Exchange Traded Funds.

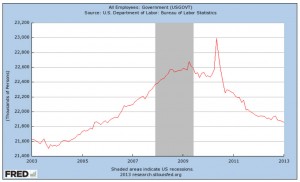

Why the U.S. Paying Down Debt Is a BAD Thing

– http://slant.investorplace.com/

On the surface, it seems like a great headline: America will pay down its debts in the current quarter, marking the first time in six years that has happened.

On the surface, it seems like a great headline: America will pay down its debts in the current quarter, marking the first time in six years that has happened.But the details are disturbing … and a sign that federal spending continues to be slashed right when the economy needs it most.

The U.S. Treasury said it expects to pay off $35 billion of debt in the April-to-June quarter…

Are These 3 Retailers Ready To Go Private?

– investopedia

Bloomberg ran an article April 29 speculating that Rue 21, Abercrombie & Fitch and Aeropostale are all possible private equity targets. Analysts believe that given the high number of deals that took place in 2012–38 valued at $5.7 billion–many more will be forthcoming in 2013.

BYD Builds in the U.S., Turns a Corner

– fool.com

Buffett’s automaker seems to be improving and heading toward a leaner, more profitable machine.

Re: Collective thoughts

– bogleheads.org

Time flies … I can’t believe I last bumped this two years ago! Still one of the most useful bookmarks I have under ‘financial’ …

Tourism is Booming — Here's How To Profit

– streetauthority.com

As we head toward Memorial Day weekend, summer travel plans are being discussed around many kitchen tables.

As we head toward Memorial Day weekend, summer travel plans are being discussed around many kitchen tables.Americans are hitting the road again, packing hotels in major cities as some national parks brace for a record number of visitors. Many conversations in foreign languages will be heard in these places as well, as international tourists are trekking to the United States in record numbers…

Nike is Ready to Make a Move

– http://www.investmentu.com/

Sometimes as investors we become obsessed with the next new thing. What’s that new company, innovation or strategy the market does not know about? If we get in on the ground floor, we tell ourselves, we’ll make a ton of cash.

But in our pursuit of finding what’s new, we sometimes overlook what’s right in front of our face…

But in our pursuit of finding what’s new, we sometimes overlook what’s right in front of our face…

Cramer's Lightning Round – The Chinese Have Pulled Back From Solar (4/29/13)

– seekingalpha.com

By SA Editor Miriam Metzinger: Stocks discussed on the Lightning Round segment of Jim Cramer’s Mad Money Program, Monday April 29.

Editor’s Note: There were no bullish calls on Monday’s program.

Bearish Calls:

SunPower (SPWR): “The Chinese have pulled back from solar.”

Sandstorm Gold (SAND): "These companies help fund the development of gold and now we have

Complete Story »

Editor’s Note: There were no bullish calls on Monday’s program.

Bearish Calls:

SunPower (SPWR): “The Chinese have pulled back from solar.”

Sandstorm Gold (SAND): "These companies help fund the development of gold and now we have

Complete Story »

3 Reasons It Could Be the Best or Worst Time for Housing

– dailyfinance.com

Filed under: Investing

The housing story, by now, is old news. Two years ago, analysts were putting out reports that housing starts were at record lows and that, by logical measures and plain common sense, we were likely entering a housing boom. Whether you heeded the advice or not, it’s clear that these reports were spot-on, if underplaying the start-and-stop nature of the industry…