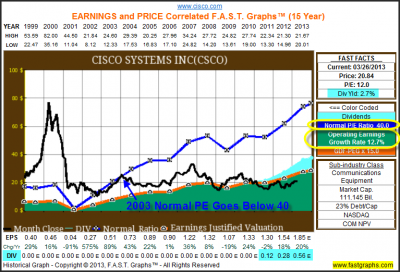

Looking For Value, Growth And Income After The Recent Market Run Up

– thediv-net.com

A

significant portion of all the great advantages that the world has

received through the promise of technology can be credited to the Big 3:

Cisco Systems Inc. (CSCO), Intel Corp. (INTC) and Microsoft (MSFT).

Great gratitude should be attributed to these technology titans,

because, thanks to them, the world enjoys a functioning Internet and

enormous productivity advances…

Welcome in my TFSA portfolio AltaGas Ltd (ALA)!

– myfirst50000.com

Its now done and completed, AltaGas Ltd (ALA) is now from my portfolio, the TFSA one. This will boost up my TFSA account value and on top of that, all the dividend earn won’t be tax.For the past few days, the TSX decreased a lot, but today, my portfolio (the non registered one) pop up to the 120k value again…

Fifth Third Bancorp Takes Over #242 Spot From ConAgra Foods

– forbes.com/sites/dividendchannel

In the latest look at the underlying components of the S&P 500 ordered by largest market capitalization, Fifth Third Bancorp (NASD: FITB) has taken over the #242 spot from ConAgra Foods, Inc. (NYSE: CAG), according to The Online Investor. Click here to find out the top S&P 500 components ordered by average analyst rating »

In the latest look at the underlying components of the S&P 500 ordered by largest market capitalization, Fifth Third Bancorp (NASD: FITB) has taken over the #242 spot from ConAgra Foods, Inc. (NYSE: CAG), according to The Online Investor. Click here to find out the top S&P 500 components ordered by average analyst rating »Why I Vastly Prefer Dividend Growth Investing To Index Investing

– dividendmantra.com

I haven’t expressly written before about the differences between dividend growth investing and index investing, and why I prefer the former over the latter. But, always better late rather than never and so I find myself compelled to put my thoughts to paper.

Before I delve too deep into this, it should be noted that I find index investing to be a fantastic strategy for a great many people out there, and probably the vast majority of investors would do better to invest in a small group of high quality, low expense index funds and be done with it…

Does Fixed Income Allocation Make Sense for Dividend Investors Today?

– dividendgrowthinvestor.com

Income portfolio diversification is important in order to maintain dependability to your dividend checks when the proverbial bad apple cuts or eliminates distributions. When a whole sector turns out to include an above average concentration of bad apples, which was the case with financials between 2007 and 2009, investors that had allocations to other sectors should have been able to maintain the level of their distributions consistent…

Adtran, Inc. (ADTN) Declares $0.09 Quarterly Dividend; 1.8% Yield

– streetinsider.com

Visit StreetInsider.com at http://www.streetinsider.com/Dividends/Adtran%2C+Inc.+%28ADTN%29+Declares+%240.09+Quarterly+Dividend%3B+1.8%25+Yield/8243717.html for the full story.

Ultimate Sustainable Dividend Portfolio – April 2013 Update

– intelligentspeculator.net

In September 2011, I did some in-depth research to find long term sustainable dividend stocks and have been doing updates on this Ultimate Sustainable dividend portfolio since then in the attempt to show how well such a portfolio can perform over the long term but also show how I would manage such a portfolio…

In September 2011, I did some in-depth research to find long term sustainable dividend stocks and have been doing updates on this Ultimate Sustainable dividend portfolio since then in the attempt to show how well such a portfolio can perform over the long term but also show how I would manage such a portfolio…4% Dividend Stocks With Upside Potential

– dividends4life.com

While most of the investment community is delving in the prospects of huge potential gains in short trades with equities such as BlackBerry (BBRY), Best Buy (BBY), etc., I’d like to digress to the more conservative and viable aspect of making money: dividend stock investing. So, I’d like to offer the community 2 dividend stocks that offer over 4% and have adequate growth potential…