The summer slump continued on Wall Street, as investors weighed a slew of mixed earnings reports against strong housing data. New home sales for June were reported to have risen 8.3% to a seasonally adjusted annualized rate of 497,000; analysts were expecting a rate of 485,000.

Invest in your financial (and personal) health with these four companies.

What New Homes Sales Mean for These Investors

– dailyfinance.com

Filed under: Investing

In this segment of The Motley Fool’s everything-financials show, Where the Money Is, banking analysts Matt Koppenheffer and David Hanson discuss some recent data around new home sales and talk about the best way for investors to play that trend.

On the heels on the surging housing market, American markets are reaching new highs, and investors and pundits alike are skeptical about future growth…

The Only Emerging-Markets Play Worth Holding 'Forever'

– streetauthority.com

A bird in the hand is worth two in the bush.

A bird in the hand is worth two in the bush.If the two market crashes since the turn of the century have taught us one thing, it is that this proverb is extremely relevant to investing.

Investors relying only to future growth in stock prices for their returns were badly burned as they saw their portfolios decimated by the dot-com bust and the Great Recession…

Cramer's Lightning Round – Green Mountain Is Too Complicated (7/23/13)

– seekingalpha.com

By SA Editor Miriam Metzinger: Stocks discussed on the Lightning Round segment of Jim Cramer’s Mad Money Program, Tuesday July 23. Bullish Calls:

Raymond James Financial (RJF): “I do like the stock. It is a terrific outfit. I’m not buying the (prediction of a) 10% correction.”

Alere (ALR): "You have a nice run there…

Raymond James Financial (RJF): “I do like the stock. It is a terrific outfit. I’m not buying the (prediction of a) 10% correction.”

Alere (ALR): "You have a nice run there…

Re: A Couple Becoming a Family: Please Let Us Know Your Thou

– bogleheads.org

I would get term life insurance – coverage should be enough to pay off a (future) mortgage, enough to allow the surviving spouse to work part time or to pay child care until the child is in school full time and enough to set aside college savings – just checked terms for a 30 year old on the Met life website (the only website I found where I didn’t need to enter personal information) – if you are born in 1980, healthy, male and nonsmoker, 750K coverage for 20 year term life insurance costs $43/month – coverage for a female with same age is $35/month – definitely something worth looking into.

The Worst Advice I’ve Ever Seen

– http://www.investmentu.com/

Last week, I spoke at The Oxford Club’s Private Wealth Seminar at the beautiful Ojai Valley Inn and Spa.

After going for a run, I was in line at the café waiting to order breakfast when a headline in the Los Angeles Times caught my eye. It said, “Crisis for the very old: Many outlive their nest eggs…

After going for a run, I was in line at the café waiting to order breakfast when a headline in the Los Angeles Times caught my eye. It said, “Crisis for the very old: Many outlive their nest eggs…

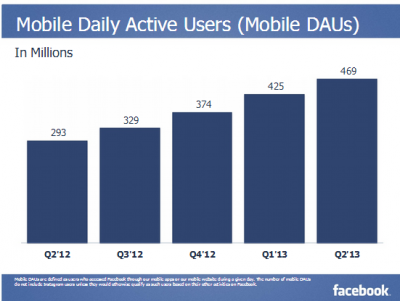

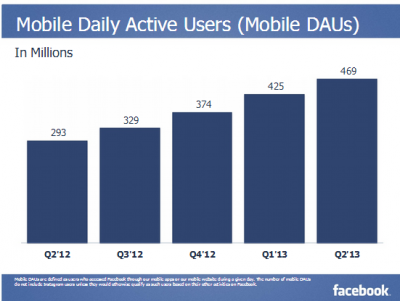

Sorry, Mr. Zuckerberg … I Was Dead Wrong to Pan Facebook

– http://slant.investorplace.com/

Back in June, I called Facebook (FB) unlikable, stating among other things that “Facebook stock is a bad investment because growth is very difficult to come by.”

Back in June, I called Facebook (FB) unlikable, stating among other things that “Facebook stock is a bad investment because growth is very difficult to come by.”Well, shares gapped up in post-market trading after Facebook earnings showed strong mobile user growth and impressive profits, with FB set to open Thursday 25% above where it was when I penned that line in June … so I guess it’s time to eat a whole plateful of crow…

ETF Store’s Geraci on Building an ETF Portfolio (Audio)

– bloomberg.com

July 24 (Bloomberg) — Nate Geraci, president of the ETF

Store, Inc., makes the case for using exchange-traded funds to

build a portfolio. Bloomberg Radio’s Catherine Cowdery reports

on Exchange Traded Funds.

Store, Inc., makes the case for using exchange-traded funds to

build a portfolio. Bloomberg Radio’s Catherine Cowdery reports

on Exchange Traded Funds.