Ken Fisher’s Biggest Stock Buys

– dividends4life.com

Ken Fisher is an investment analyst and founder, chairman and CEO of Fisher Investments. In his asset management company he serves around USD37.63 billion. His portfolio invested money in 474 companies; 48 of his stock holdings are completely new. Fisher has big investments within the technology sector, but financial shares and consumer stocks are also very important for his asset allocation…

Microsemi Larger Than S&P 500 Component Apollo Group

– forbes.com/sites/dividendchannel

In the latest look at stocks ordered by largest market capitalization, Russell 3000 component Microsemi Corp. (NASD: MSCC) was identified as having a larger market cap than the smaller end of the S&P 500, for example Apollo Group, Inc. (NASD: APOL), according to The Online Investor. Click here to find out the top S&P 500 components ordered by average analyst rating »

Pfizer, Inc. (PFE) Declares $0.24 Quarterly Dividend; 3.4% Yield

– streetinsider.com

Visit StreetInsider.com at http://www.streetinsider.com/Dividends/Pfizer%2C+Inc.+%28PFE%29+Declares+%240.24+Quarterly+Dividend%3B+3.4%25+Yield/8457154.html for the full story.

If Your Long Term Retirement Account Isn’t Extremely Boring….

– intelligentspeculator.net

The other day I met a girl who was discussing how she was so excited to be buying Apple and wanted to get involved in Facebook . As you probably know, I’m more than sold on both stocks and would happily buy Apple or Facebook (if it were public). She then proceeded to explain to me that she had 3-4K saved for retirement and investing into those 2 companies would be so “exciting”, it was going to feel as if she were part of these 2 incredible success stories…

The other day I met a girl who was discussing how she was so excited to be buying Apple and wanted to get involved in Facebook . As you probably know, I’m more than sold on both stocks and would happily buy Apple or Facebook (if it were public). She then proceeded to explain to me that she had 3-4K saved for retirement and investing into those 2 companies would be so “exciting”, it was going to feel as if she were part of these 2 incredible success stories…FED Shuts Off the Light; Is The Party Over?

– thedividendguyblog.com

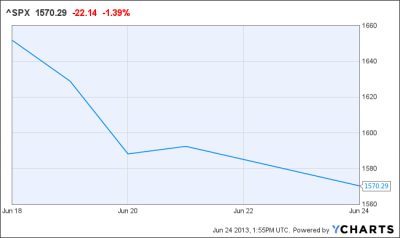

It seems like the stock market is hitting another bumpy road! After seeing several companies declaring profits and getting positive economic indicators; it’s time for our bi-polar friend to show the darkest side of its personality. Are we heading towards a bearish summer? Let’s take a deeper look at what happened over the last week…

If you followed the S&P 500 last week, you noticed it went from a high of 1651 down by almost 100 points to 1570 on Friday…

Waste Management (WM) Unappealing for 2013

– thediv-net.com

Waste Management Inc. (WM) is the largest collector and disposer of trash in North America.

-Seven Year Annual Revenue Growth Rate: 0.6%-Seven Year Annual EPS Growth Rate: Negative-Seven Year Annual Dividend Growth Rate: 8.5%-Current Dividend Yield: 3.63%-Balance Sheet Strength: Leveraged, Stable

I view WM to be overpriced currently at around $40…