Downsides of Extreme Saving

– myfijourney.com

I spend a of this blog focusing on extreme saving, which I would consider to be anything above 20%. Why? Because extreme saving is an extremely powerful tool for achieving early financial independence or retirement. Without it, you’re going to resort to such fallback plans as rich dead relatives, becoming a drug kingpin, winning the lotto, or starting an unusually successful business…

I spend a of this blog focusing on extreme saving, which I would consider to be anything above 20%. Why? Because extreme saving is an extremely powerful tool for achieving early financial independence or retirement. Without it, you’re going to resort to such fallback plans as rich dead relatives, becoming a drug kingpin, winning the lotto, or starting an unusually successful business…My Lifestyle Inflation – A New House

– ayoungpro.com

Last week I mentioned that I had two exciting things happen to me recently. I wrote about taking a vacation to New York City last week. This week I wanted to share the news that we have moved into our new house which is my personal lifestyle inflation stemming from my new job. I know many of you wanted to hear about it and see some pictures, so this post is for you…

How My Credit Card Saved Me Over $250

– moneylifeandmore.com

A few weeks ago I confessed to you about how I fell for a too good to be true wedding dress that I bought online. The original dress cost me $257. Then I ended up buying a new dress which ended up being another $645.

A few weeks ago I confessed to you about how I fell for a too good to be true wedding dress that I bought online. The original dress cost me $257. Then I ended up buying a new dress which ended up being another $645.I was really bummed because the two dresses together were nearly one third of my total wedding budget…

Learning to Invest in Stocks with Virtual Investing

– theamateurfinancier.com/blog/

Like many people, I’ve been interested in stock market investing for much of my adult life. Not just the standard ‘buy an index fund that invests in the stock market, add money to it regularly, and hold it until you retire’ standard investing advice. Don’t get me wrong, it’s sound advice; if you do that with at least a sizable portion of your money from a relatively young age, you’ll find yourself quite well-off when retirement time rolls around…

Like many people, I’ve been interested in stock market investing for much of my adult life. Not just the standard ‘buy an index fund that invests in the stock market, add money to it regularly, and hold it until you retire’ standard investing advice. Don’t get me wrong, it’s sound advice; if you do that with at least a sizable portion of your money from a relatively young age, you’ll find yourself quite well-off when retirement time rolls around…5 Personal Finances Blogs I Recommend to Our Customers

– www.enemyofdebt.com/

Serious about getting out of debt? Read these!

Serious about getting out of debt? Read these!In my role as Social Media Manager, I wind up conversing with all kinds of people looking for information about debt. Some of these folks have already enrolled in CareOne debt relief plans; some are just looking for resources to do it on their own.

I like to send a variety of resources to people to help them find their way with personal finance…

Tips To Protect Yourself From Financial Scums Of The World

– doablefinance.com

The scums and the schmucks of the financial world dealing with your finances are increasingly on the rise. You cannot completely, 100%, protect yourself from them. But, in real life, like anything else, you just have to try to somehow beat the scums at their own game. In a handful of states, there are laws …

I Just Wrote a Check for $3,500…

– clubthrifty.com

I Just Wrote a Check for $3,500…

I Just Wrote a Check for $3,500…Club Thrifty – Stop spending. Start living.Yes, folks. You heard it. I just wrote a check for 3,500 smackaroos…and it wasn’t for anything awesome like a vacation to Aruba or a hot tub for my back deck. Unfortunately, the $3,500 check I just wrote was the June 15th installment of my personal income taxes…

Why are people still paying full-retail price for things?

– johnnymoneyseed.com

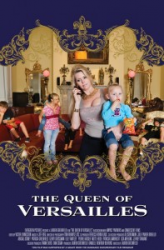

If you’re in the mood to punch things, watch this movie!

If you’re in the mood to punch things, watch this movie!A few months ago, Mrs. Moneyseed and I realized that we’d never been on a single actual vacation since we got married three years ago. We’ve taken a few trips to see our families, which have always been nice, but those can hardly be considered “vacations”…

Is financial planning only a modern-day concept?

– dinksfinance.com

Good morning Dinks. As a financial planner I had a lot of clients in their 30s and 40s. Over the years I have had a few clients who are older and retired, but not too many. My older clients weren’t actually looking for financial planning advice; they were more looking for wealth management, tax efficient and income generating ways to preserve their wealth…

How Much do you Spend on Birthday Gifts?

– monsterpiggybank.com

Deciding how much to spend on birthday gifts is a very difficult thing to work out. You don’t want to be too stingy, but you don’t want to go broke either. My wife and I decided a while ago that we would stop giving presents to people for the big commercial holidays like Christmas, but that we would be happy to spend a bit more on birthday presents for people to make up for it…

Deciding how much to spend on birthday gifts is a very difficult thing to work out. You don’t want to be too stingy, but you don’t want to go broke either. My wife and I decided a while ago that we would stop giving presents to people for the big commercial holidays like Christmas, but that we would be happy to spend a bit more on birthday presents for people to make up for it…Things I Would Never Do: Raid My 401k to Buy Property

– frugalrules.com

Welcome to my monthly installment of things I would never do. I started this series last month to shed light on some maybe unwise practices that may not always be the best idea from a financial perspective. Again, it’s not meant to be judgmental in nature but more informative and possibly humorous…

Great Last Minute Father’s Day Gift Ideas

– debtroundup.com

If you forgot, Father’s Day is this Sunday, 6/16. Since I am a first time father celebrating Father’s Day for the first time, my wife has been asking me for gift ideas. I have never thought about gifts because I have a hard enough time to come up with gift ideas for my birthday. As I have grown older, I have enjoyed spending time with family over the material gifts…

If you forgot, Father’s Day is this Sunday, 6/16. Since I am a first time father celebrating Father’s Day for the first time, my wife has been asking me for gift ideas. I have never thought about gifts because I have a hard enough time to come up with gift ideas for my birthday. As I have grown older, I have enjoyed spending time with family over the material gifts…Broke in Retirement: Why It’s Important to Know Where Your Money Is.

– eyesonthedollar.com

Every time I go back to visit my family in the South, it seem that I learn something new. Once I learned from an uncle that you can collect insurance money if your cow is struck by lightning. Good or bad, I also learn more than I want about family members. Generally there are no secrets, and most stories make me chuckle, like the two cousins who got into a fist fight over their deceased mother’s couch at the funeral home…

Every time I go back to visit my family in the South, it seem that I learn something new. Once I learned from an uncle that you can collect insurance money if your cow is struck by lightning. Good or bad, I also learn more than I want about family members. Generally there are no secrets, and most stories make me chuckle, like the two cousins who got into a fist fight over their deceased mother’s couch at the funeral home…How Much Does Your Car Cost?

– savvyfinanciallatina.com/#&panel1-

I Just Bought A Camaro!

Dang, don’t I wish that was true! No, I didn’t buy a Camaro, but I know someone who just did. I overheard one of my department’s director brag about how he just bought a brand new Camaro! He’s picking it up on Thursday.

His team members (direct reports) reacted by saying “That’s awesome!” “Super Cool!”

A quick Google search online for “Average costs of a Camaro” brings up an average range of $23,345 – $60,546…

Dang, don’t I wish that was true! No, I didn’t buy a Camaro, but I know someone who just did. I overheard one of my department’s director brag about how he just bought a brand new Camaro! He’s picking it up on Thursday.

His team members (direct reports) reacted by saying “That’s awesome!” “Super Cool!”

A quick Google search online for “Average costs of a Camaro” brings up an average range of $23,345 – $60,546…

7 Paths to Successful Blogging

– weonlydothisonce.com

This guest post was written by Chad Goulde of The Blog Builders. Visit blogbuilders.com today to learn even more great paths to successful blogging.

This guest post was written by Chad Goulde of The Blog Builders. Visit blogbuilders.com today to learn even more great paths to successful blogging.Before you even think about starting your blog, you better already know your niche. If your blog doesn’t have a specific niche, you will never be able to narrow down your target market…

What Are High-Deductible Health Plans? Who Do They Hurt?

– studentdebtsurvivor.com

Last week at work we had a meeting with Human Resources. The purpose of the meeting? To tell employees that our organization (a large non-profit) can no longer keep our current health insurance plan because of the cap the feds put on the amount of money non-profits can spend on fringe benefits (don’t get me started on this one, I’ll address that “issue” at another time)…

Last week at work we had a meeting with Human Resources. The purpose of the meeting? To tell employees that our organization (a large non-profit) can no longer keep our current health insurance plan because of the cap the feds put on the amount of money non-profits can spend on fringe benefits (don’t get me started on this one, I’ll address that “issue” at another time)…How Much Money Do You Need for Retirement?

– edwardantrobus.com

Retirement (Photo credit: 401(K) 2013)

Retirement (Photo credit: 401(K) 2013)Last year, I wrote that I felt that some people may be over-insured and that financial advisers and bloggers held the standard much too high for what qualifies as a sufficient amount of life insurance. A recent article on Untemplater got me thinking that this same is also true for retirement…

Mutual of Omaha Bank Review

– doughroller.net

Mutual of Omaha Bank is a subsidiary of the century-old Mutual of Omaha insurance company, and, like its parent company, it’s known for its conservative values. This FDIC-insured bank offers a wide range of financial products and accounts, including a credit card, money market savings account, checking account and mortgage program…

When is the Best Time to Get a Dog?

– commoncentswealth.com

Our dog, Kimora

It’s no secret, I love pets. I’ve either had or want to have just about any type of pet you can imagine. Of all of the pets I’ve had (including dogs, cats, turtles, fish, snails, rabbits, etc.), dogs are by far my favorite. There is a reason they call them a “man’s best friend”…