Sell in May and Go Away? Worst Investing Advice or Sound Investment Choice?

– thedividendguyblog.com

It’s fun to see how a serious field like investing comes with these semi-astrological predictions…

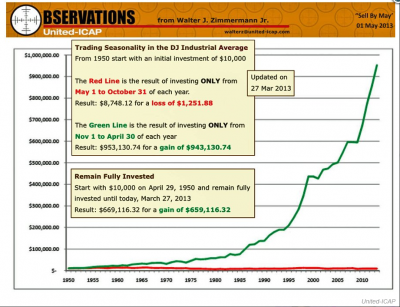

There is an old saying telling investors to sell in May and come back in October. This is the result if you follow the “Sell in May and Go Away” along with “Buy back on Saint Crispin’s Day” which is in late October…

STAG Industrial (STAG) Declares $0.30 Quarterly Dividend; 5.4% Yield

– streetinsider.com

Visit StreetInsider.com at http://www.streetinsider.com/Dividends/STAG+Industrial+%28STAG%29+Declares+%240.30+Quarterly+Dividend%3B+5.4%25+Yield/8309420.html for the full story.

T Mobile US Larger Than S&P 500 Component Cliffs Natural Resources

– forbes.com/sites/dividendchannel

In the latest look at stocks ordered by largest market capitalization, Russell 3000 component T Mobile US (NYSE: TMUS) was identified as having a larger market cap than the smaller end of the S&P 500, for example Cliffs Natural Resources, Inc. (NYSE: CLF), according to The Online Investor. Click here to find out the top S&P 500 components ordered by average analyst rating »

In the latest look at stocks ordered by largest market capitalization, Russell 3000 component T Mobile US (NYSE: TMUS) was identified as having a larger market cap than the smaller end of the S&P 500, for example Cliffs Natural Resources, Inc. (NYSE: CLF), according to The Online Investor. Click here to find out the top S&P 500 components ordered by average analyst rating »Dividend Investing – Telecom, Real Estate and Energy

– dividendninja.com

Bell Aliant: 7.11%

The telecom giant has gone through a much needed transformation over the last few years. From multiple mergers to restructuring the company into deferent components, the company has transformed its self into a communication company giant…

A Disciplined Approach To Dividend Stocks

– thediv-net.com

Those that have read this space for any period of time are well aware of my enthusiasm for using dividend growth stocks as a vehicle for building long-term wealth and income. However, with that said, a successful investor must do more than just buy stocks that pay a growing dividend, or do more that focusing on a single metric such as dividend yield…

Those that have read this space for any period of time are well aware of my enthusiasm for using dividend growth stocks as a vehicle for building long-term wealth and income. However, with that said, a successful investor must do more than just buy stocks that pay a growing dividend, or do more that focusing on a single metric such as dividend yield…Four Select Dividend Increases of Note

– dividendgrowthinvestor.com

I track the list of dividend increases every week for the stocks I own. Over the past week, there were 49 companies that raised dividends. I scanned the list and focused on the ones I own as well as another that I have been patiently waiting to purchase for the past two years. Whether the market goes up or down from here, these dependable dividend payers will continue generating the earnings…

If The Future Of Mobile Lies In The Clouds… Is Apple (AAPL) In Trouble In Its Battle With Google (GOOG)?

– intelligentspeculator.net

As many of you know, TechCrunch is one of my favorite Tech blogs and I loved one specific post that came out this weekend:

As many of you know, TechCrunch is one of my favorite Tech blogs and I loved one specific post that came out this weekend:-Google’s cloud is eating Apple’s lunch

I invite you to take a read if you are interested about either or both of these stocks. Jon Evans basically explained how Google has been able to dominate most cloud-based services such as Google Now, Google Maps (vs Apple maps), Google Drive (vs iCloud), etc…

Colgate-Palmolive (CL) Dividend Stock Analysis

– dividendmonk.com/

Colgate-Palmolive Company (NYSE: CL) is a $56 billion market-cap consumer products company with strong market share in tooth paste and soap.

Colgate-Palmolive Company (NYSE: CL) is a $56 billion market-cap consumer products company with strong market share in tooth paste and soap.-Seven Year Revenue Growth Rate: 6.0%

-Seven Year EPS Growth Rate: 11.3%

-Seven Year Dividend Growth Rate: 11.9%

-Current Dividend Yield: 2.25%

-Balance Sheet Strength: Strong

Colgate’s strong product appeal and unusually wide global reach (even among American blue-chips) give investors a lot to like, but the fairly high stock valuation of the company keeps the dividend yield on the lower side and reduces or eliminates any margin of safety…

Dividend Stocks Can Come Back to Bite You

– dividends4life.com

Low interest rates have put pressure on millions of investors who rely on bank CDs and other safe investments for their income. In response, many of them have replaced some of their former exposure to fixed-income investments with dividend stocks. Although making that move will get you a lot more income than a bank CD will, you need to understand the risks you’re taking by boosting your holdings

About this past weekend (sorry, this only a hello post, no investment story to tell or almost)

– myfirst50000.com

Did you have a nice weekend? Mine had been AWESOME! I usually do my cleaning, laundry and everything else on Sunday, but knowing how gorgeous the weather was going to be, I took care of the cleaning on Friday evening.On Saturday, I wake up around 9 AM, which I rarely do and I went out for breakfast. Following what, I did my grocery shopping…