Face Retirement Head On

– retireby40.org/

Message for RSS readers

Message for RSS readersSorry to interrupt, but if you are reading this on Google Reader, you will need to figure out a different way to follow us. Google is getting rid of Google Reader soon and you should switch to other RSS readers such as Feedly instead.

Subscribe to have every article delivered to your inbox and you won’t have to worry about the RSS problems…

Top 10 Canadian Dividend Growth Stocks for 2013

– milliondollarjourney.com

Reader Mailbag: The Arrival of Spring

– thesimepledollar.com

1. Parents and loans

2. Moving back in with parents

3. Handling my tax refund

4. Advice for military son

5. Income for an expectant mother

6…

Get The Most Out Of ‘Free Giveaway’ Marketing Promotion

– libertyinvestor.com

Everyone likes the idea of getting a free gift along with a purchase that they want or need; but the amount of emotion evoked by the product they intend to purchase impacts how you should go about offering a free gift in order to ensure that your product or service stands out…

Retail Therapy: Men vs. Women

– budgetsaresexy.com/

Saw another interesting survey go out the door recently, this time focusing on retail therapy. And just like with the last one we blogged about (the debt between Generation X and Y), you always have to take these with a grain of salt since most are done to help sell/promote a company 😉 But nonetheless they’re fun to talk about…

Tips for Vetting a Work from Home “Opportunity”

– financialhighway.com/

Working from home is a dream for many. After all, what’s better than sleeping in, and then getting up to do work in your pajamas? You can set your own schedule, and make good money.

Working from home is a dream for many. After all, what’s better than sleeping in, and then getting up to do work in your pajamas? You can set your own schedule, and make good money.While this can be true, the reality is often that you need to be careful about the work from home “opportunity” you are being offered…

5 Major Components of Health Care Reform and What They Mean for You

– youngadultmoney.com/

The new Health Care Reform law in the United States, formally as the Patient Protection and Affordable Care Act (PPACA), is a complicated law.

Today I want to go over five of the major components of Health Care Reform and what they mean for you. Some won’t affect you at all and never will; others may have a major impact on your life (and possibly already have)…

18 Awesome, Practically Free Upcycled Craft Projects

– wisebread.com

I like to make stuff.

I sew or knit a lot of my own clothes. I cook from scratch. I try to only give handmade gifts. But, because I am on an itty bitty budget, I am constantly on the hunt for ways to reduce the cost of my crafting habit. Seriously, if you look at my checkbook it looks like I have a drug habit…

Your Biggest Money Worries – and How to Eliminate Them

– moneytalksnews.com

Last Monday was April Fools’ Day, but it was also the kickoff of Financial Literacy Month.Two groups – the National Foundation for Credit Counseling (NFCC) and the Network Branded Prepaid Card Association (NBPCA) – marked the occasion with their 2013 Financial Literacy Survey.Now in its seventh year, the survey asks Americans about their personal finance habits, hopes, fears, and dreams…

Last Monday was April Fools’ Day, but it was also the kickoff of Financial Literacy Month.Two groups – the National Foundation for Credit Counseling (NFCC) and the Network Branded Prepaid Card Association (NBPCA) – marked the occasion with their 2013 Financial Literacy Survey.Now in its seventh year, the survey asks Americans about their personal finance habits, hopes, fears, and dreams…Can I Get Away with Lying on My Life Insurance Application?

– moneyinfant.com

Invest in this: How I pick stocks

– getrichslowly.org/blog

Lazy People (Like Me) Can Still Save Money

– solvingthemoneypuzzle.com/

I am lazy by nature and I am learning to be frugal and surprisingly the 2 go hand in hand. Being lazy can save you money.

Homekeeping

I think homekeeping is the term that Martha Stewart uses for making your house a shiny testament to your cleaning abilities. Everything that Martha does is anti-lazy and usually anti-frugal…

Debt Scholarship Sponsor: Miranda Marquit, Planting Money Seeds

– debtmovement.com/blog/

Website or Company

Website or CompanyPlanting Money Seeds

What is your background with debt and how did you conquer the financial obstacles in your life?

I racked up the debt in college, and took out student loans, even though I had scholarships and didn’t need them.

I’m still paying on the student loans, but the interest is much lower, thanks to consolidation in 2005…

I need a personal assistant

– punchdebtintheface.com

So I was driving home last night and the host of the radio show I was listening to proposed a question to all of his listeners. I thought it was kind of an awkward question. This is what he asked: If you could get paid to do something you already do on a regular basis, what would pick? Some callers chimed in and said things like “Get paid to go to the bathroom every morning” or “Get paid to clean my apartment…

How to Buy a Car with Bad Credit and No Cosigner

– moneysmartlife.com

Can you buy a car with bad credit and not have to use a cosigner? The answer is yes, however it is not nearly as clean and neat as buying a car with a conventional loan. You have to use your imagination, and prepare for a less comfortable situation. Here are some options:

Can you buy a car with bad credit and not have to use a cosigner? The answer is yes, however it is not nearly as clean and neat as buying a car with a conventional loan. You have to use your imagination, and prepare for a less comfortable situation. Here are some options:1. The old standby: pay cash…

How to Make Extra Money With Dogvacay

– genxfinance.com/

If you love dogs, have space in your home to board them, and want to make extra cash, DogVacay is the right website for you. Apply to be a host and once accepted, start providing a safe haven for dogs of all sizes. Pet owners rest assured that their furry friends are being cared for in a loving and humane way and you get the added benefit of companionship and extra income…

Money Has No Borders

– libertyinvestor.com

The point is that when the world as we expect to relate to it is turned on its head, that’s newsworthy…

Samsung Chromebook Review ($249 Version)

– 20somethingfinance.com/

Earlier this year, I picked up a Samsung Chromebook (wi-fi version).

Earlier this year, I picked up a Samsung Chromebook (wi-fi version).There are a number of different and more expensive Chromebooks out there – all the way up to the premium Chromebook Pixel, touch-screen, which retails for $1,299. So what makes the Samsung Chromebook worth highlighting here?

The wi-fi enabled version retails for $249 (there is also a 3G version that retails for $80 more)…

How to Negotiate Lower Monthly Payments on Just About Anything

– moneyning.com/

It seems like everything we do is set up on a payment schedule. We make monthly payments for rent, mortgages, credit cards, school loans, and car payments. We even make payments for our music — Pandora One, anyone?

It’s a convenient way of life, especially since few people have the means to pay for all the things they need at once…

Fees and Commissions: How Much of Your Money Is Actually Being Invested?

– canadianfinanceblog.com

One of the most common misconceptions of casual investors is that all of their money is in fact being invested. Sorry people, but that is not the case!

One of the most common misconceptions of casual investors is that all of their money is in fact being invested. Sorry people, but that is not the case!To at least some extent you, as an investor, have to pay in the form of fees and commissions to invest your money. Where is your money really going?

Many of the costs associated with investing are fairly well hidden because they are grouped with overall investment profits and losses…

Spring Cleaning Tasks to Get a Head Start On

– prairieEcothrifter.com

It may seem hard to believe with the weather recently, but spring is on it’s way. I already have some tulips coming up in the planter at the front door. Spring is a wonderful time of year, but with spring comes spring cleaning.

It may seem hard to believe with the weather recently, but spring is on it’s way. I already have some tulips coming up in the planter at the front door. Spring is a wonderful time of year, but with spring comes spring cleaning.I actually enjoy the thought of spring cleaning. There is something about the thought of being organized and starting a season off on the right (clean) foot that is satisfying…

Investing Lessons from Monopoly

– freemoneyfinance.com

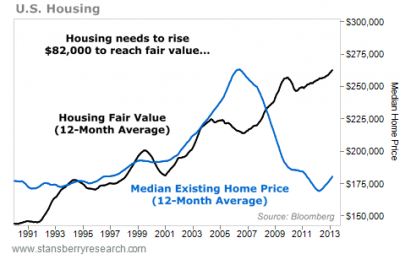

Exactly How High Home Prices Should Go

– libertyinvestor.com

“This market is going crazy,” a realtor friend just told me.

“This market is going crazy,” a realtor friend just told me.“Just this week, I got a beach condo under contract; and I got four more offers within 36 hours.”

For years, I have urged you to buy housing in Florida. I’ve told you housing here is attractively priced. And it will rise in price faster than just about anyone expects over the next decade…