Insurance: An easier way to comparison shop

– getrichslowly.org/blog

3 Reasons You Should Blog

– youngadultmoney.com/

I started Young Adult Money less than a year ago, but I’ve actually been blogging for years. I started out as a political blogger, then was a music blogger, and finally found my way to the personal finance blogosphere. Besides being a blogger myself, I read tons of blogs. The blogs I read on a daily basis usually fall under one of three categories: personal finance/lifestyle, Spreadsheet/Database, and political…

Spend $25,000 to Save $9,000?

– budgetsaresexy.com/

I finally got my act together and sat with my account for tax stuff! And MAN does that always feel so good – regardless of the outcomes 🙂 Just to knock something off your brain and free up more space, ya know? Hate those nagging thoughts that continually linger…

And just like all years, I am always shocked that I don’t owe as much as I always think I will in the end 🙂 Mainly out of ignorance, I suppose, but regardless better to be shocked with positive news than with negative! Especially when dealing with money owed to someone…

Ask the Readers: What Is Your Favorite Frugal Food?

– wisebread.com

Tasty food doesn’t have to cost a lot. You can save on fresh ingredients at the grocery store, or save time by cooking in large batches, or get creative with leftovers to make a meal last — whatever it takes to get your favorite food on the table!

What is your favorite frugal food? Is it a dish you make yourself, or an ingredient that you often use? Do you have a recipe to share?

Tell us about your favorite frugal food and we’ll enter you in a drawing to win a $20 Amazon Gift Card!

Win 1 of 3 $20 Amazon Gift Cards

We’re doing three giveaways — here’s how you can win!

Mandatory Entry:

Post your answer in the comments below…

How to Impress Your Boss (Without Giving Up Your Work/Life Balance)

– prairieEcothrifter.com

It seems that maintaining your personal life while trying to climb the corporate ladder or enhance your work life is nearly impossible. It’s incredibly hard to balance work and family, which is why it is such a hot topic.

It seems that maintaining your personal life while trying to climb the corporate ladder or enhance your work life is nearly impossible. It’s incredibly hard to balance work and family, which is why it is such a hot topic.You can impress your boss without working 12 hours per day and working late into the evenings…

What Does Early Retirement Feel Like? The Positives And Negatives Of Not Working For A Living

– financialsamurai.com

Rabbit TV Review, TV on the Internet

– genxfinance.com/

I recently bought a device called Rabbit TV. Reminiscent of the Magic Jack, this handy gadget plugs into the USB port on your desktop or laptop computer and gives you access to over 5,000 Internet TV channels, 25,000 movies, and 50,000 radio stations for free. Just plug it in, download the software, register your account, and enjoy…

I recently bought a device called Rabbit TV. Reminiscent of the Magic Jack, this handy gadget plugs into the USB port on your desktop or laptop computer and gives you access to over 5,000 Internet TV channels, 25,000 movies, and 50,000 radio stations for free. Just plug it in, download the software, register your account, and enjoy…Top 8 Free Money Apps

– financialhighway.com/

John Hancock Thinks I’m on the Path to Retirement

– freemoneyfinance.com

I have both my contributions and investments on auto-pilot (as you might imagine) and I put in the maximum amount each year…

Figuring Out the Size of Your Emergency Fund

– thesimepledollar.com

Let’s start off with the basic idea of what an emergency fund is. I like Dave Ramsey’s definition of an emergency fund: An emergency fund is a rainy day fund, an umbrella…

3 Ways To Kill Your Debt

– canadianfinanceblog.com

Debt sucks. I mean, don’t get me wrong. Going into debt can be fun. It’s that trip to Maui or the new laptop you need for school. It can be one too many trips to the bar with your friends and another little black dress (and matching shoes, of course). Spending all of that money is terribly fun, so putting it onto a credit card or dipping into a line of credit can practically make sense when your desires outweigh that sinking feeling in the back of your head…

Debt sucks. I mean, don’t get me wrong. Going into debt can be fun. It’s that trip to Maui or the new laptop you need for school. It can be one too many trips to the bar with your friends and another little black dress (and matching shoes, of course). Spending all of that money is terribly fun, so putting it onto a credit card or dipping into a line of credit can practically make sense when your desires outweigh that sinking feeling in the back of your head… March is National Nutrition Month. It may seem as though such a month would be redundant here in America, where the national conversation on food is never-ending, but it is important for all of us to take a minute (or a month) to reassess our nutritional health.

March is National Nutrition Month. It may seem as though such a month would be redundant here in America, where the national conversation on food is never-ending, but it is important for all of us to take a minute (or a month) to reassess our nutritional health.As a personal finance blogger with an interest in nutrition, however, I get extremely irritated at the number of articles that simply tell readers to go forth and buy leafy greens…

Why Income Security is the New Job Security

– moneysmartlife.com

Until about a decade or so ago, employees were heavily concerned with job security. It’s not that that’s no longer a concern – it’s just that it’s so much harder to come by now. For this reason, income security has become the new job security. If it’s impossible to be guaranteed a job, then the next best thing is working to make sure you at least have a steady income…

Until about a decade or so ago, employees were heavily concerned with job security. It’s not that that’s no longer a concern – it’s just that it’s so much harder to come by now. For this reason, income security has become the new job security. If it’s impossible to be guaranteed a job, then the next best thing is working to make sure you at least have a steady income…How Parents Can Maximize Tax Deductions & Credits for Children

– moneycrashers.com

What if you always maxed out your 401(k)

– retireby40.org/

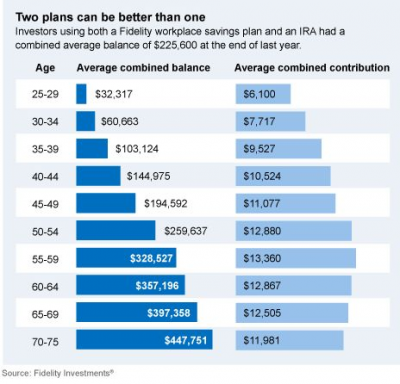

How much do you have saved in your 401(k)? If you max out your 401(k) contribution every year since you started working, you would have a good size retirement portfolio by now. However, if you are like the average worker, your retirement account balance is woefully low. Fidelity Investment analyzed nearly one million investors’ retirement accounts and here is the result…

How much do you have saved in your 401(k)? If you max out your 401(k) contribution every year since you started working, you would have a good size retirement portfolio by now. However, if you are like the average worker, your retirement account balance is woefully low. Fidelity Investment analyzed nearly one million investors’ retirement accounts and here is the result…Will Working Harder Really Help You Get Ahead?

– moneyning.com/

Hard work is considered a virtue in our society. The assumption is that hard work will lead to more money, and to career success.

Lots of money is proof of a good work ethic. If you don’t have the job you want, with the pay you want, you’re supposed to work harder, and you’ll eventually be rewarded…

Don’t Let Divorce Be Your Financial Downfall

– debtmovement.com/blog/

Divorce is a life changing event that is sure to have an impact on everything from your emotions to your finances.

Divorce is a life changing event that is sure to have an impact on everything from your emotions to your finances.When it happened to me, transitioning from two incomes to one required budget and lifestyle adjustments on my part.

Everyone’s situation is going to be different, but most people will experience tightened budgets and possibly additional debt accrued throughout the divorce process…

Today’s Deals: Tents, Toys, and Free Photos

– moneytalksnews.com

I subscribe to the promotional emails of hundreds of companies so you don’t have to. I sift through 1,000 deal-touting emails every week. Most are worthless. But some offer valuable coupons, promo codes, sales, and freebies – which I collect and organize.Note: Expiration dates are in brackets.OutdoorsCamping gear: $20 off a $100 purchase of Coleman tents or accessories at Amazon…

I subscribe to the promotional emails of hundreds of companies so you don’t have to. I sift through 1,000 deal-touting emails every week. Most are worthless. But some offer valuable coupons, promo codes, sales, and freebies – which I collect and organize.Note: Expiration dates are in brackets.OutdoorsCamping gear: $20 off a $100 purchase of Coleman tents or accessories at Amazon…Eating my words

– punchdebtintheface.com

Remember the controversial post I wrote a month or two ago titled “Screw my Roth IRA” where I blew the whistle on why Roths suck? Many of you wanted to burn me at the stake; accusing me of financial blasphemy. The comments section of that post got a little heated, but with the help of some fellow PDITF readers, my point was actually getting through to those who originally opposed it…

Hey Americans! Cut Your Saturday Mail Delivery

– solvingthemoneypuzzle.com/