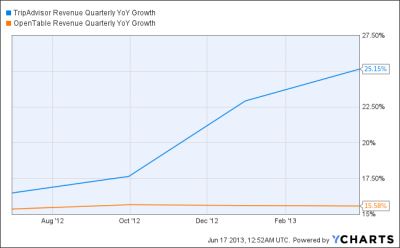

New Trade: Long TripAdvisor ($TRIP) & Short OpenTable ($OPEN)

– intelligentspeculator.net

This morning I sent out a newsletter to the members of my tech stock focused mailing list about companies that are playing the long game (it’s one of the key things I look for when making speculative longer term investments). I spent a lot of time thinking about it this weekend and today’s post fits very well…

This morning I sent out a newsletter to the members of my tech stock focused mailing list about companies that are playing the long game (it’s one of the key things I look for when making speculative longer term investments). I spent a lot of time thinking about it this weekend and today’s post fits very well…Arlington Asset Investment Cor (AI) Declares $0.875 Quarterly Dividend; 12.4% Yield

– streetinsider.com

Visit StreetInsider.com at http://www.streetinsider.com/Dividends/Arlington+Asset+Investment+Cor+%28AI%29+Declares+%240.875+Quarterly+Dividend%3B+12.4%25+Yield/8423725.html for the full story.

Trimble Navigation Larger Than S&P 500 Component Helmerich & Payne

– forbes.com/sites/dividendchannel

In the latest look at stocks ordered by largest market capitalization, Russell 3000 component Trimble Navigation Ltd. (NASD: TRMB) was identified as having a larger market cap than the smaller end of the S&P 500, for example Helmerich & Payne, Inc. (NYSE: HP), according to The Online Investor…

Why Investors Are Dumping Dividend Stocks

– dividends4life.com

With 10-year Treasury yields rising to their highest level in more than a year from last summer’s historical lows, it should come as no surprise that stocks which benefitted from a search for yield bonds are now tanking. Earlier in the year, tech was the least-loved sector as investors chased stocks with traditionally high dividends…

Why This Blog Exists

– dividendmantra.com

This weekend, Dividend Mantra hit 1,000,000 pageviews! Simply amazing. I started this blog back in March, 2011 never anticipating any kind of readership at all. I thought I would put my information out there and hopefully a couple people would find some inspiration and I could start some kind of dialogue with like-minded investors…

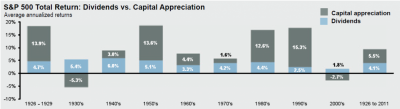

Why Dividend Investing Will Always Be Better Than Buying the Entire Stock Market

– thedividendguyblog.com

I’ve read a lot of comments about the potential dividend bubble for the past 12 months. Some investors are afraid to see so much money leaving bonds and money market funds to be piled into dividend paying stocks. Most investors are craving for revenue and dividend stocks are pretty much the answer to this desire… unless they continue to starve with their bonds and CDs paying less interest than I pay my kids!

But the fact remains: dividend investing is far more solid than a simple bubble created by a few retirees looking to receive a big fat check every month…

5 Quality Dividend Stocks To Take The Emotion Out Of Investing

– thediv-net.com

Deep-down in my soul, I am a contrarian. The significant market run-up this year has converted most of the great dividend stock buys into ‘ok’ buys (at best). Sure the increase in your portfolio’s value leaves you with a warm and fuzzy feeling, but as a long-term investor, I would much rather buy stocks at a deep discount…

Deep-down in my soul, I am a contrarian. The significant market run-up this year has converted most of the great dividend stock buys into ‘ok’ buys (at best). Sure the increase in your portfolio’s value leaves you with a warm and fuzzy feeling, but as a long-term investor, I would much rather buy stocks at a deep discount…Lower Entry Prices Mean Locking Higher Yields Today

– dividendgrowthinvestor.com

The beauty of dividend investing is that once an investor purchases a quality income stock, they can hold on to it for many decades, while patiently collecting cash dividends. The success of a dividend growth investor depends not only on picking the best companies in the world, but also purchasing them at the right price and holding on to them for as long as possible…