Anyone who has ever been in a road accident or had their car stolen by a carjacker would know how it feels to bear the burden of paying an additional amount to their car loan lender. In an unexpected event like an accident or theft, your car insurance company will only pay you for what the car is worth at that time.

For instance, once you buy a car, the car is officially termed as used and it’s value depreciates in the market. As the years go by the value of your car gets lower and lower, however, you still have to pay the monthly payment calculated keeping the car’s original price in mind. Not to mention, the interest.

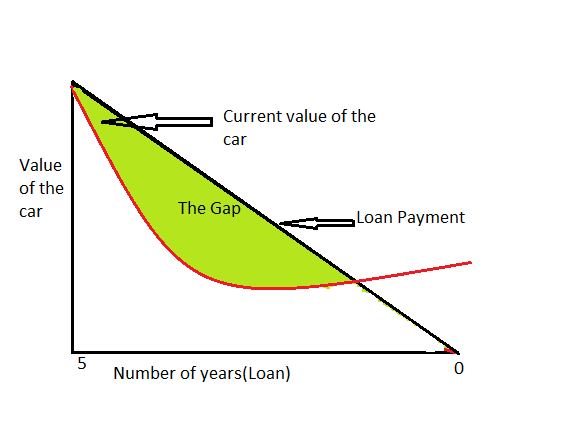

As you can see from the graph, the value of the car(red line) depreciates with time. However, the monthly loan payment remains the same. So, if you were to find yourself in a road accident or your car got stolen, your car insurance company will only pay for the current market value of the car. Without gap insurance(Guaranteed Asset Protection), you will have to continue making a high monthly payment.

Gap insurance fills the gap between the current value of the car and the loan amount you are due to pay. The green part in the diagram depicts this gap. Furthermore, you should also take into consideration the fact that after 3-4 years, the value of the car will get higher than the monthly amount you pay to the car loan lender(as it decreases with time). No matter how old your car gets, it will still have fair value in the market.

Who should buy gap insurance?

Buying a car that depreciates faster than other vehicles is one of the biggest reasons to buy gap insurance. The faster the value of a car depreciates the less your car insurance company will offer you(if something happens to your car). This can happen when you are buying a new untested model. So, do not forget to buy gap insurance at the time of buying a car. To get total benefits from your gap insurance, you also will need to finance the car for 60 months or longer.

Who does buying gap insurance make no sense?

Buying gap insurance makes no sense for those who bought the car by paying a high down payment. If you made a downpayment worth 30-35% of the value of the car, your monthly loan payments will always be lower in relation to the current market value of the car. At every point on the graph, the value of the car is going to be higher than the money you owe to the lender. Hence, in such a scenario, it makes no sense to purchase gap insurance.

Conclusion

Once you purchase a car, its value begins to depreciate with every passing month. So, If I was to purchase a gap insurance a year after buying the car, it will be difficult to get the application for the gap insurance approved. Also, the insurance company will be liable to charge a higher monthly premium.