How To Know When To Take Profits? A Discussion Of Fear And Greed In Stock Market Investing

– financialsamurai.com

There are two things investors need to battle on a constant basis. The first thing is fear. We must eradicate fear when markets are collapsing because we know great fear is when fortunes are made. I distinctly remember when the S&P 500 closed at its low of 666 on March 6, 2009. The mark of the devil was such an insult to injury on Wall Street that hardly anybody decided to buy that day…

Being Kind to the Poor

– freemoneyfinance.com

For those of you new to Free Money Finance, I post on The Bible and Money every Sunday. Here’s why.

Today I’m posting Proverbs 19:17, one of my favorite Bible verses. I’ve shared it before, but as I’m making my way through Proverbs I ran into it and couldn’t help posting it yet again. From the NIV:He who is kind to the poor lends to the Lord, and he will reward him for what he has done…

Today I’m posting Proverbs 19:17, one of my favorite Bible verses. I’ve shared it before, but as I’m making my way through Proverbs I ran into it and couldn’t help posting it yet again. From the NIV:He who is kind to the poor lends to the Lord, and he will reward him for what he has done…

Before You Get a Pet, Be Aware That They Can Be Money Sinks

– thesimepledollar.com

Sarah and I are very close friends with a couple who are dog lovers. They have two Saint Bernards in their home.

I quite like their dogs. One of them has awful breath, so I somewhat avoid him, but the other one is a charmer. I’ll pet them and play with them a bit every time I go visit them. In both cases, the dogs were rescued from animal shelter situations, and I applaud my friends for doing that…

I quite like their dogs. One of them has awful breath, so I somewhat avoid him, but the other one is a charmer. I’ll pet them and play with them a bit every time I go visit them. In both cases, the dogs were rescued from animal shelter situations, and I applaud my friends for doing that…

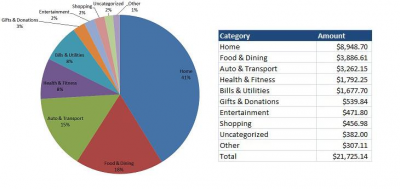

What Do You Mean “You Don’t Track Your Finances”?!

– youngcheapliving.com

I’ve figured out why some people are broke while others aren’t. Broke people are broke because they are not tracking their finances while others are building wealth because they are. Yes, it’s true and I’m sorry to have to break the news to those of you who are broke. It is a harsh reality…

I’ve figured out why some people are broke while others aren’t. Broke people are broke because they are not tracking their finances while others are building wealth because they are. Yes, it’s true and I’m sorry to have to break the news to those of you who are broke. It is a harsh reality…Creating objective rules for spending

– getrichslowly.org/blog

This guest post is from Mr. F, an Australian reader in his mid-20s who works for the government. We’re often told to “spend money on what’s important,” “spend according to your values” or “spend on whatever takes up most of your time.” So, for example, you should spend money when it comes to things like education, or family, or on a mattress…