Social Stocks Are Just Getting Started ($FB, $LNKD, $TRIP)

– intelligentspeculator.net

This is not the first or the last time that I comment on social stocks but to give some context to newer readers, I’ve been a big believer in these stocks because of their ability to be “sticky” and provide unique content that is very difficult to compete with. Facebook (FB) and LinkedIn (LNKD) are the two clear social plays…

This is not the first or the last time that I comment on social stocks but to give some context to newer readers, I’ve been a big believer in these stocks because of their ability to be “sticky” and provide unique content that is very difficult to compete with. Facebook (FB) and LinkedIn (LNKD) are the two clear social plays…Stocks for Dividend Growth with Low Risk

– dividends4life.com

In this screen, we turned our attention to comparatively low-risk stocks that have good records for dividend growth. In addition, our selection criteria focused on those issues that our analysts project will continue providing investors with dividends that are likely to increase at above-average rates…

CI Financial About To Put More Money In Your Pocket (CIX)

– forbes.com/sites/dividendchannel

On 7/29/13, CI Financial Corporation (Toronto: CIX) will trade ex-dividend, for its monthly dividend of $0.09, payable on 8/15/13. As a percentage of CIX’s recent stock price of $31.50, this dividend works out to approximately 0.29%. Click here to find out which 9 other Canadian stocks going ex-dividend you should know about, at DividendChannel…

Financial Independence Is Both A Journey And A Destination

– thediv-net.com

It’s been said that life is a journey, not a destination. I believe that to be true. Always planning for tomorrow and keeping your eye on the future will give you a lack of appreciation for the moment at hand. I am sometimes guilty of this, as planning for retirement before the age of 40 takes a great deal of thought, vision and fortitude…

Westamerica Bancorp (WABC) Declares $0.37 Quarterly Dividend; 3% Yield

– streetinsider.com

Visit StreetInsider.com at http://www.streetinsider.com/Dividends/Westamerica+Bancorp+%28WABC%29+Declares+%240.37+Quarterly+Dividend%3B+3%25+Yield/8532589.html for the full story.

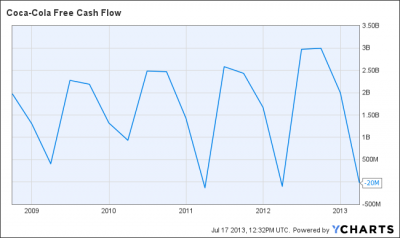

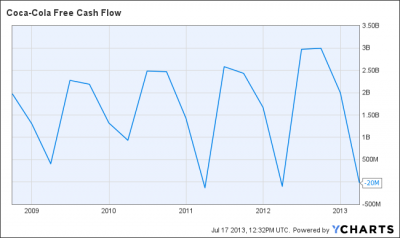

What if The Dividend Payout Ratio Was Bogus? How About Using Free Cash Flow?

– thedividendguyblog.com

After completing a session of “Dividend Questions from the Mailbag” a few weeks ago, I enjoyed a very interesting discussion with one of my readers, Robert from Dividend Growth Investing. We were looking at the popular way of taking the payout ratio as a good indication to determine a company’s ability to distribute its dividend over time…