Funny Ways We Save Money On Summer Roadtrips

– ptmoney.com

Roadtrips are a fun and inexpensive way to enjoy the summer. These vacations are always memorable, although not always in the ways we’d imagine.

Roadtrips are a fun and inexpensive way to enjoy the summer. These vacations are always memorable, although not always in the ways we’d imagine.If you’ve taken a summer road trip, it might have gone something like this, especially when you’re trying to save a few bucks.

Agonize for days over finding the best vacation deals…

Are You Making These Five Retirement Planning Mistakes?

– prairieEcothrifter.com

We all make mistakes. However, some mistakes can impact us more than others. When you make mistakes with your retirement planning process, you could put your entire future at risk.

We all make mistakes. However, some mistakes can impact us more than others. When you make mistakes with your retirement planning process, you could put your entire future at risk.As you save for retirement, here are Five planning mistakes to avoid.

1. Overestimating Returns

Remember back when the rule of thumb was that you could expect 10% annual returns from your investments? Looking at the rule now, it seems a little excessive…

The Best Time to Have Children

– thesimepledollar.com

If a couple has a child when they’re younger, the medical risks are lower, the parents are much more likely to be in good health throughout their childhood, and they can focus on their career during their 40s and 50s…

The Best, Worst, and Craziest Jobs.

– budgetsaresexy.com/

Just read an interesting article over at Yahoo Finance talking about the best and worst jobs to go into debt for. None of which I even thought or cared about back in the day (I just wanted one I thought was fun and could get a reasonable degree in, haha…), but I’m sure there are smarter kids out there right now reading and contemplating this as I type 🙂

This post is for you guys…

Millions of American Homeowners Could Refinance and Save with HARP

– onecentatatime.com

by Clayton Closson

You read that title correctly.

An estimated 2.7 million American households could refinance to today’s mortgage rates (which are near historic lows, in case you haven’t been paying attention) through the gov’s HARP program…

How to Get Free Apps on Your iPhone Without Hidden Costs

– moneysmartlife.com

Apple’s App Store has seen over 50 billion downloads since its inception. Some of those apps are paid, other iPhone apps are free with ads, and a minuscule amount are free without ads. Considering Apple gets a 30% cut of any paid app download they’ve made quite a bit of money thanks to the developers that publish those apps…

Apple’s App Store has seen over 50 billion downloads since its inception. Some of those apps are paid, other iPhone apps are free with ads, and a minuscule amount are free without ads. Considering Apple gets a 30% cut of any paid app download they’ve made quite a bit of money thanks to the developers that publish those apps…Survey: America’s Rich Are Self-Made

– libertyinvestor.com

According to the survey, conducted earlier this year by BMO Private Bank, a surprising number of wealthy Americans accomplished their financial goals themselves, with very few attributing their wealth to inheritance…

4 Things Everyone Should do to Save Electricity

– 20somethingfinance.com/

I live in mid-Michigan – home of the muggy, swamp-ass summer (although nothing like the mid-south, I will admit). I still use air conditioning at night during the worst muggiest summer nights. I also don’t own any Energy Star kitchen or laundry appliances, and I have an electric dryer and dishwasher…

How To Deal With People Who Flash Their Money

– youngadultmoney.com/

Let’s set the scene: You’re at dinner with a group of people. Some you know well. Others you’re just meeting for the first time. The conversation is initially normal and friendly, covering topics like work, hobbies, and kids. Inevitably, one gentleman can’t help but bring down the party by flashing his wealth…

Let’s set the scene: You’re at dinner with a group of people. Some you know well. Others you’re just meeting for the first time. The conversation is initially normal and friendly, covering topics like work, hobbies, and kids. Inevitably, one gentleman can’t help but bring down the party by flashing his wealth…Income Tax Return Filing FAQ’s (ITR)

– thinkplaninvest.com

The time has come for the income tax filing, which is most important part for the tax payer in the year. Even though this process repeats every year, still most of the people searching for the guide to know how to file returns and not remembering the meaning for various terms…

What Are Your Habits Costing You?

– moneyning.com/

As a baseball player, I often see people using chewing tobacco. This got me thinking about habits — both good and bad — and what they cost us.

My wife and I enjoy getting coffee from Dunkin Donuts in the morning, while some people enjoy traveling or shopping. Anything that we do consistently is a habit, and these habits often come with a price tag…

SteveDH, May 2013 Net Worth

– consumerismcommentary.com/

Naked With Cash is the year-long series on Consumerism Commentary where seven readers’ households share their financial progress on a monthly basis. I’ve partnered with financial planners who will offer some guidance along the way. Read this introduction to learn more about the series. This month, the participants and experts will be discussing retirement as part of their analyses…

Naked With Cash is the year-long series on Consumerism Commentary where seven readers’ households share their financial progress on a monthly basis. I’ve partnered with financial planners who will offer some guidance along the way. Read this introduction to learn more about the series. This month, the participants and experts will be discussing retirement as part of their analyses…

Join our Tweetchat this Thursday at 12:00 pm Pacific for lively conversation and a chance to win prizes! Use #WBChat to participate.

This week’s topic: Party planning on a budget! Learn about frugal invites, saving on food and drinks, and choosing a theme! Tell us about how you entertain party guests on the cheap and let us know your #1 way to save money when planning a party!

For an easy way to keep track of the conversation, try using our special Tweetchat Chatroom…

Five factors for your asset allocation

– getrichslowly.org/blog

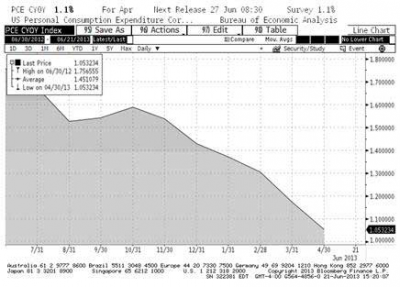

Don’t Let The Fed Get You Down

– libertyinvestor.com

May 22 and June 19 are two days that every investor wants to forget about. But the one man who won’t and can’t is Ben Bernanke, the current and (soon to be) outgoing chief of the Federal Reserve bank (Fed) and the chairman of its Federal Open Market Committee (FOMC).

May 22 and June 19 are two days that every investor wants to forget about. But the one man who won’t and can’t is Ben Bernanke, the current and (soon to be) outgoing chief of the Federal Reserve bank (Fed) and the chairman of its Federal Open Market Committee (FOMC).I say outgoing because that’s what President Barack Obama told talk show host Charlie Rose right before last week’s FOMC meeting…

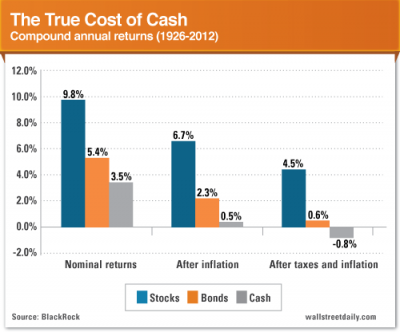

Charting The Most Dangerous, Wealth-Destroying Investment In The World

– libertyinvestor.com

The Fed speaks. Stocks tank. And now I’m here with a friendly public service announcement: Don’t give in to your flight instinct. Running for cover in cash right now promises to be the worst possible move.

The Fed speaks. Stocks tank. And now I’m here with a friendly public service announcement: Don’t give in to your flight instinct. Running for cover in cash right now promises to be the worst possible move.I know; I know. Cash is supposed to be the ultimate safe haven — a riskless investment, if you will…

Study: Wealthy People More Likely to Lie, Cheat and Take Candy From Kids

– moneytalksnews.com

Upper-class people are more prone to unethical behavior, research indicates.In a series of experiments, University of California at Berkeley psychology professor Paul Piff found that people who are better off act differently from their poorer peers. A PBS Newshour segment documented some of his findings, which include:While 90 percent of California drivers follow a law requiring them to stop for pedestrians at crosswalks, people who drive luxury vehicles are three to four times more likely not to…

Upper-class people are more prone to unethical behavior, research indicates.In a series of experiments, University of California at Berkeley psychology professor Paul Piff found that people who are better off act differently from their poorer peers. A PBS Newshour segment documented some of his findings, which include:While 90 percent of California drivers follow a law requiring them to stop for pedestrians at crosswalks, people who drive luxury vehicles are three to four times more likely not to…