Recent Buy

– dividendmantra.com

Just what us value investors were all waiting for! The S&P 500 is down some 3.9% over just the last couple days after Ben Bernanke, the Federal Reserve Chairman, hosted a news conference discussing the possibility of cutting back on some of the stimulus to the economy via quantitative easing…

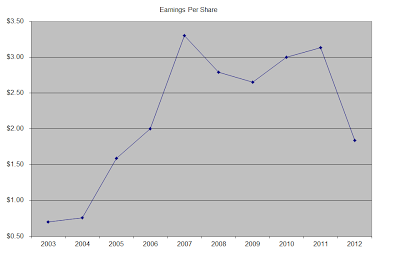

Archer Daniels Midland Stock Analysis

– thediv-net.com

Archer-Daniels-Midland Company (ADM) manufactures and sells protein meal, vegetable oil, corn sweeteners, flour, biodiesel, ethanol, and other value-added food and feed ingredients. This dividend champion has paid dividends since 1927, and has increased them for 37 years in a row.

Archer-Daniels-Midland Company (ADM) manufactures and sells protein meal, vegetable oil, corn sweeteners, flour, biodiesel, ethanol, and other value-added food and feed ingredients. This dividend champion has paid dividends since 1927, and has increased them for 37 years in a row.

The company’s last dividend increase was in February 2013 when the Board of Directors approved an 8…

Archer-Daniels-Midland (ADM) Dividend Stock Analysis 2013

– dividendgrowthinvestor.com

Archer-Daniels-Midland Company (ADM) manufactures and sells protein meal, vegetable oil, corn sweeteners, flour, biodiesel, ethanol, and other value-added food and feed ingredients. This dividend champion has paid dividends since 1927, and has increased them for 37 years in a row.

The company’s last dividend increase was in February 2013 when the Board of Directors approved an 8…

Weekly Dividend Hits

– thedividendguyblog.com

Let’s jump into the dividend links!

1. I’m Not Buying Stocks, I’m Buying Ownership In High Quality Companies @ Dividend Mantra.

2. How to dump your big-bank financial advisor @ My Own Advisor.

3. Can’t Believe How Much My Financial Life Has Changed @ MJTM.

4. TripAdvisor (TRIP) Has Much Higher To Go @ IS…

1. I’m Not Buying Stocks, I’m Buying Ownership In High Quality Companies @ Dividend Mantra.

2. How to dump your big-bank financial advisor @ My Own Advisor.

3. Can’t Believe How Much My Financial Life Has Changed @ MJTM.

4. TripAdvisor (TRIP) Has Much Higher To Go @ IS…

Con-Way Larger Than S&P 500 Component Apollo Group

– forbes.com/sites/dividendchannel

In the latest look at stocks ordered by largest market capitalization, Russell 3000 component Con-Way Inc (NYSE: CNW) was identified as having a larger market cap than the smaller end of the S&P 500, for example Apollo Group, Inc. (NASD: APOL), according to The Online Investor. Click here to find out the top S&P 500 components ordered by average analyst rating »

Dividend Increase: MDT

– dgmachine.blogspot.com/

Medtronic (MDT) is increasing its quarterly dividend by 7.7%, from $0.26 to $0.28 per share, putting the company on track for its 36th consecutive year of dividend growth (news release). Given that I own 55 shares of MDT, my quarterly dividend increases from $14.30 to $15.40 and my yield on cost becomes 3…

Zep (ZEP) Declares $0.04 Quarterly Dividend; 1% Yield

– streetinsider.com

Visit StreetInsider.com at http://www.streetinsider.com/Dividends/Zep+%28ZEP%29+Declares+%240.04+Quarterly+Dividend%3B+1%25+Yield/8439071.html for the full story.

Weekend Readings – Congrats to the Miami Heat

– intelligentspeculator.net

I’m not a huge NBA fan but I’ve gotta say that it was an amazing final and what a comeback by the Heat, did any of you end up watching it? Congrats to Lebron and the others on another remarkable season!!

I’m not a huge NBA fan but I’ve gotta say that it was an amazing final and what a comeback by the Heat, did any of you end up watching it? Congrats to Lebron and the others on another remarkable season!!General Readings

-How the Robots Lost: High-Frequency Trading’s Rise and Fall @ BusinessWeek

-Investment options are not comforting @ CuriousCat

Dividend/Passive Income Readings

-Dividend investing will always beat the entire market @ TheDividendGuyBlog

-Dividend income is more stable than capital gains @ DividendGrowthInvestor

-Best of luck to Dividend Ninja @ Dividend Ninja

Tech Stock Readings

-Google (GOOG) internet balloons @ Wired

-Will Zynga (ZNGA) shareholders be compensated for their patience? @ SeekingAlpha

-The Genius of Uber @ Pragmatist

The post Weekend Readings – Congrats to the Miami Heat appeared first on Intelligent Speculator.

Benefits Of Dollar Cost Averaging Into Dividend Stocks

– dividends4life.com

When the benefits of dollar cost averaging are typically discussed, the focus is generally upon the fact that you are putting yourself in a position to achieve returns that mirror the long-term performance of the index funds or specific stocks that you choose to own. The obvious beneficial thing about dollar cost averaging is that you eliminate the risk of buying at market highs (the hindsight