Avoid No-Growth Dividend Stocks

– dividends4life.com

When building a dividend growth portfolio many people look at how many consecutive years a company has increased its dividend. A company that has raised its dividend every year for 50 consecutive years, for example, is likely to continue the practice. But this record of consistency alone is not enough to justify a place in my Ultimate Dividend Growth Portfolio, a paper portfolio which you can

Seagate Technology (STX) Declares $0.38 Quarterly Dividend; 4.1% Yield

– streetinsider.com

Visit StreetInsider.com at http://www.streetinsider.com/Dividends/Seagate+Technology+%28STX%29+Declares+%240.38+Quarterly+Dividend%3B+4.1%25+Yield/8295321.html for the full story.

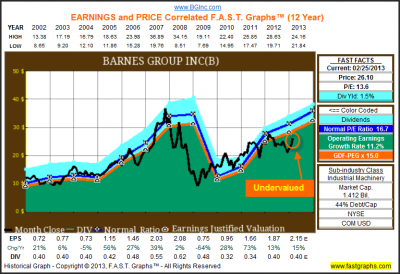

Barnes Group Inc: Fundamental Stock Research Analysis

– thediv-net.com

Before analyzing a company for investment, it’s important to have a perspective on how well the business has performed. Because at the end of the day, if you are an investor, you are buying the business. The FAST Graphs™ presented with this article will focus first on the business behind the stock…

Before analyzing a company for investment, it’s important to have a perspective on how well the business has performed. Because at the end of the day, if you are an investor, you are buying the business. The FAST Graphs™ presented with this article will focus first on the business behind the stock…Twenty Dividend Stocks I Recently Purchased for my IRA Rollover

– dividendgrowthinvestor.com

As I mentioned in an earlier article, I am ramping up my contributions to a 401 (k) plan, in order to reduce current tax liabilities and enjoy tax free compounding of gains. However, I already had an old 401 (k), which was eligible for a rollover. In early April I cashed out the index funds in it, and rolled the money over into an IRA…

Oneok Inc. (OKE) Valuation Estimate

– dividendmonk.com/

Oneok Inc. (OKE) is a natural gas utility company that owns the General Partner of Oneok Partners LP (OKS).

Oneok Inc. (OKE) is a natural gas utility company that owns the General Partner of Oneok Partners LP (OKS).-Seven Year EPS Growth Rate: 4.1%

-Seven Year Dividend Growth Rate: 12.6%

-Current Dividend Yield: 2.80%

-Balance Sheet Strength: Investment Grade

Overview

I published a stock report last week on Oneok Partners LP (NYSE: OKS), which is a relatively large natural gas and NGL master limited partnership…

Top Ranked Dividend Stock UTI Becomes Oversold

– forbes.com/sites/dividendchannel

The DividendRank formula at Dividend Channel ranks a coverage universe of thousands of dividend stocks, according to a proprietary formula designed to identify those stocks that combine two important characteristics — strong fundamentals and a valuation that looks inexpensive. Universal Technical Institute, Inc…

The DividendRank formula at Dividend Channel ranks a coverage universe of thousands of dividend stocks, according to a proprietary formula designed to identify those stocks that combine two important characteristics — strong fundamentals and a valuation that looks inexpensive. Universal Technical Institute, Inc…DGI Case Study – $5K to $100K In Three Years

– dividendmantra.com

My Portfolio Screenshot

Wow. I did it. On March 13, 2013 my total portfolio value (including cash) exceeded $100,000. That’s six-figures folks. And I did it before my 31st birthday.

How did this happen?

Well, let’s take a look back. In January 2010 I found myself with $7,000 in my checking account and over $25,000 in student loan debt…

Top 100 Dividend Stocks – May 2013 Edition

– intelligentspeculator.net

Dividend investing is a huge part of my investment strategy. As I’ve mentioned in my now monthly passive income updates, receiving dividend income from my both my Ultimate Sustainable Dividend portfolio and my ETF portfolio is a primary driver of how my retirement will be like a few decades from now:)

Dividend investing is a huge part of my investment strategy. As I’ve mentioned in my now monthly passive income updates, receiving dividend income from my both my Ultimate Sustainable Dividend portfolio and my ETF portfolio is a primary driver of how my retirement will be like a few decades from now:)Today I’m looking at the top S&P500 dividend stocks…

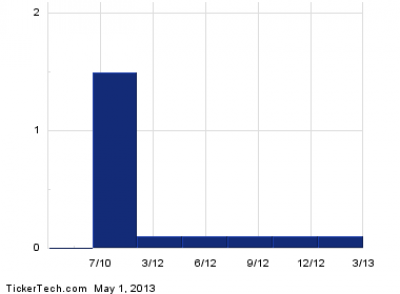

TSX 60 Ex Dividend Date + Best 2013 Dividend Stock Update +20.03%

– thedividendguyblog.com

At the beginning of each month, I make a recap of the dividend yield and ex dividend date of the TSX 60. In addition to this recap, I’ve decided to cover briefly the result of my Best 2013 Dividend Stock Book. This book includes 30 stocks analysis (20 US and 10 CDN) for only $2.99. So far, my results are:

20 US Dividend Stocks: +20…

Take Control of Your Financial Future Seminar – Slides and Notes

– dividendninja.com

This presentation is from the Take Control of Your Financial Future Seminar, held on Saturday April 20th, 2013, at the University of British Columbia.

The seminar was sponsored by the Canadian MoneySaver…

Welcome back, 120k worth non-registered portfolio. And welcome sunshine!

– myfirst50000.com

I am just very glad that I am back on the 120k value for my non-registered portfolio! I closed today session at $120 730. It would be nice if it could simply remain that way. When my portfolio go down, I always find it hard to imagine it will ever go up again… but it always does… May God bless Canada! We have the best stock market of the world…