Where To Invest In A Rising Interest Rate Environment?

– financialsamurai.com

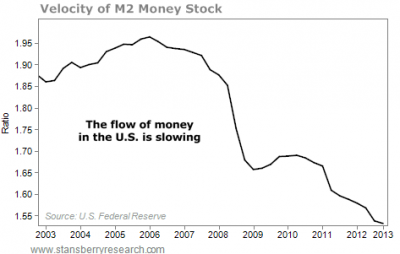

At long last stock market volatility returns due to rising interest rates. We’ve now seen a more than 60% increase in the risk free rate since its 2012 bottom and things are starting to get hairy. I’ve been wrongly waiting for a pull back since the beginning of May so it’s good to finally get some sanity back in the markets again…

At long last stock market volatility returns due to rising interest rates. We’ve now seen a more than 60% increase in the risk free rate since its 2012 bottom and things are starting to get hairy. I’ve been wrongly waiting for a pull back since the beginning of May so it’s good to finally get some sanity back in the markets again…Wave Goodbye to Expensive Entertainment and Head Over to the Beach for Cheap Fun

– prairieEcothrifter.com

Those of you who live near a beach have probably grown used to the sights and sounds of the ocean, but people living inland like myself are counting down the days until they can leave work or school behind and head for the sand. Coastal citizens often forget, though, that a beach is a haven for entertainment–at little to no cost to you…

Those of you who live near a beach have probably grown used to the sights and sounds of the ocean, but people living inland like myself are counting down the days until they can leave work or school behind and head for the sand. Coastal citizens often forget, though, that a beach is a haven for entertainment–at little to no cost to you…Best Deals for Friday 06/21

– wisebread.com

Link for teaser title:http://www.wisebread.com/deals

Virgin America offers select fares starting at $58.90, KitchenAid takes 40% off sitewide, 2 Mossimo Chiffon Dresses $25, and more!

Debt Isn’t Required

– thesimepledollar.com

I had this strong sense that I needed all of those things now to show the world and those around me that I had somehow arrived in adulthood…

64% of you Need to Get Rid of your Landline or ISP VOIP. NOW!

– 20somethingfinance.com/

There is about 145,000 monthly searches on Google per month, on average, for “what is a landline?”.

There is about 145,000 monthly searches on Google per month, on average, for “what is a landline?”.That should tell you about all you need to know regarding our shift away from good ole’ landline phone services.

Shockingly, despite that fun metric, 64% of Americans still have a landline phone! This boggles my mind…

What’s Going On With Inflation Today… And What To Do About It

– libertyinvestor.com

Every month, about 300,000 Americans celebrate their 65th birthday. This is the age most of us think of when we hear “retirement.”

Every month, about 300,000 Americans celebrate their 65th birthday. This is the age most of us think of when we hear “retirement.”The arch nemesis of those newly minted retirees is inflation.

Most folks looking to retire need safe investment income. This traditionally comes from owning bonds, which pay a fixed rate…

Is There Tax on Large 529 Contributions?

– moneyning.com/

529 plans are an excellent way to help your children, grandchildren, or nieces and nephews save for college. Not only are they easy to set up and maintain, but they also grow tax-deferred, and distributions are completely tax-free if they’re used for qualified education expenses.

However, things can get a little complicated if you decide to make a large contribution to a 529 plan…

Friday Giveaway Roundup – 111 Giveaways

– youngadultmoney.com/

Photo by Slam Szapucki

Welcome to the weekly Friday giveaway roundup! Every single Friday we post giveaways ending within the next week. If you want to make sure you never miss one of these posts be sure to subscribe via RSS or Email.

Happy Friday everyone!

This week really got away from me. I’m not sure what it was, but I definitely felt “behind” all week…

Three Current Themes Precious Metals Investors Need to Consider

– libertyinvestor.com

And now I know exactly what the next five years will bring…

Benefit of Joint Accounts, Claiming Medical Expenses, Basics of Nutrition and More!

– milliondollarjourney.com

Non-Financial Investments That Can Help Your Financial Situation @ Sustainable Personal Finance

What You Need to Know When Claiming Medical Expenses @ Canadian Finance Blog

What happens to your spending in the summer? @ Retire Happy Blog

What Low Interest Rates Mean for New Homeowners and Prospective Buyers @ Young and Thrifty

Thinking Fast and Slow @ Michael James on Money

Basics of nutrition @ Balance Junkie

How to dump your big-bank financial advisor@ My Own Advisor

White ATM Machines Same as Pay Day Loans @ Canadian Personal Finance Blog

In Defense Of Smallenfreuden @ Boomer and Echo

Implement These Small Home Office Ideas on a Budget @ Financial Highway

Can’t Keep up? 15 Ways to Simplify Your Morning Routine @ Pick The BrainPopular Posts:

Canadian Discount Brokerage Comparison

Top 6 ways to Save on Auto Insurance

High Interest Rate Savings Accounts

Top Cash Back Credit Cards in Canada

Questrade Review

Are Hybrid Vehicles Worth it?

Tax Free Savings Account (TFSA)

Copyright 2012 MillionDollarJourney – All Rights Reserved

Related Posts:Free Seminar with Ed, Bye Bye Ally, Less is More with CRADating & Money, Sustainable Landscaping, Tablet or…Giveaway Winners, Monthly Dividend Paying Stocks, Ally…97 Month Car Loan, Lending Money To Friends and Family,…Broad-based vs…

Do you have a Money road map?

– retireby40.org/

Hey Everyone,

Hey Everyone,I’m still on vacation so today, I’m reposting one of my old articles from 2010. We probably had about 10 readers or so back then so most of you haven’t seen this yet.

This is a flowchart of what we do with our money. Take a look and tell me what you think.Basically, Green shapes are good and we aim to build those accounts up…

Ask the Readers: What would it take to quit your job and pursue your passion?

– getrichslowly.org/blog

Not Hired? Your Credit Report May Be to Blame

– moneytalksnews.com

As if job seekers didn’t have enough to worry about — add credit reports to the list.”Employers’ use of credit checks during the hiring process is legal and fairly common,” The Wall Street Journal says.How common? About 47 percent of employers screen some candidates with a credit check, it says. Checks are most likely for senior executive positions, and obviously for those with financial responsibilities…

As if job seekers didn’t have enough to worry about — add credit reports to the list.”Employers’ use of credit checks during the hiring process is legal and fairly common,” The Wall Street Journal says.How common? About 47 percent of employers screen some candidates with a credit check, it says. Checks are most likely for senior executive positions, and obviously for those with financial responsibilities…Quick Money Tips: The Art of Minimalism

– ptmoney.com

Is it time to clear some of the clutter?In today’s edition, we take a look at minimalism. There are plenty of extreme minimalists out there who live happy, full lives with very little stuff. Their idea is to not clutter life with things in order to appreciate what really matters.

Is it time to clear some of the clutter?In today’s edition, we take a look at minimalism. There are plenty of extreme minimalists out there who live happy, full lives with very little stuff. Their idea is to not clutter life with things in order to appreciate what really matters.The average American consumer can have a really hard time appreciating this idea…

Top 10 Ways to Beat Your Bills Big Time

– moneysmartlife.com

Don’t let your bills get the best of you. You can save money, get a better deal, and still enjoy many of the things you enjoy in your daily life. Here are some tips on how to overcome your monthly bills.

Don’t let your bills get the best of you. You can save money, get a better deal, and still enjoy many of the things you enjoy in your daily life. Here are some tips on how to overcome your monthly bills.10 Ways to Save on Monthly Costs

1. Don’t have bills.

The easiest way to beat you bills? Don’t have them…

Writing Wrap Up + A 3 Legged Goat

– budgetblonde.com

Hi Everyone! Welcome to another writing wrap up!

Grenada/Life Update

I don’t have beach pictures for you this week, but I did snap a picture of the goat guy. I’m pretty fond of that little three legged goat hobbling a little bit behind the others. Can you see it?

Also, my friend snapped this picture of my hubby and two of his friends at school last week…

Protecting Yourself From ID Theft

– libertyinvestor.com

Net Worth Calculator: Calculating Your Financial Net Worth

– canadianfinanceblog.com

Calculating your net worth can be a potentially scary task, as it is going to require you to come to terms with exactly how much you owe. You might feel safe and secure in your home, but you may owe more than your house is worth. Calculating your net worth will force you to address your financial situation…

Calculating your net worth can be a potentially scary task, as it is going to require you to come to terms with exactly how much you owe. You might feel safe and secure in your home, but you may owe more than your house is worth. Calculating your net worth will force you to address your financial situation…LastDollar, May 2013 Net Worth

– consumerismcommentary.com/

This month is Insurance Month in the series Naked With Cash. Each month, seven Consumerism Commentary readers anonymously share their financial reports to gain insight about their progress towards their goals. Read this introduction to learn more about the series. LastDollar is thirty-three years old, an entrepreneur and single mom with two children with learning differences in private school…

This month is Insurance Month in the series Naked With Cash. Each month, seven Consumerism Commentary readers anonymously share their financial reports to gain insight about their progress towards their goals. Read this introduction to learn more about the series. LastDollar is thirty-three years old, an entrepreneur and single mom with two children with learning differences in private school…The Bigger Better Game!

– budgetsaresexy.com/

You know that show where those two guys trade up stuff they get for bigger and better items? And try and outdo each other and come away with something ridiculously huge at the end? (I think it’s called Barter Kings?) Well, I came across an item last weekend yard sale’ing that prompted me to give the game a shot myself 🙂

You know that show where those two guys trade up stuff they get for bigger and better items? And try and outdo each other and come away with something ridiculously huge at the end? (I think it’s called Barter Kings?) Well, I came across an item last weekend yard sale’ing that prompted me to give the game a shot myself 🙂Let me set the scene for you: My mother, sister and I are roll up to a new yard sale together and we see something glittering at the front of the driveway…